All You Need To Know About Bitcoin ETF

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

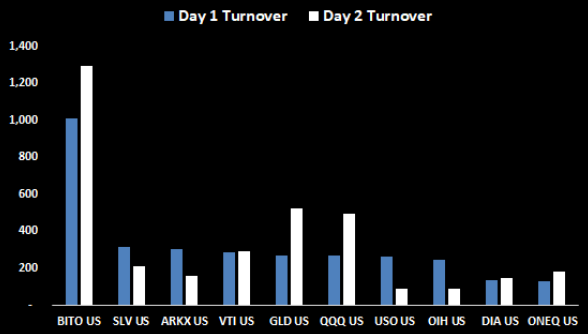

This week on Tuesday, the first U.S. bitcoin exchange-traded fund (ETF) from ProShares is launched, ending around six years of demand and anticipation. The first two days of Bitcoin ETF $BITO‘s volume vs the next most successful ETF launches of all time was very impressive. It did double any of them, and is in good co w/ second day growth (see $QQQ, $GLD)

Eric Balchunas and James Seyffart from Bloomberg have been on top of reporting the entire ETF saga. The ETF ended the first day of trading with $570 million in total assets and there was more than $1 billion in trading volume (including after-hours), which is a record for day one of an ETF launch.

Followed by ETF announcement, on 21st Oct, Houston Firefighters Pension Fund has officially become the first pension fund in the United States to purchase, and directly hold, bitcoin in their portfolio. Earlier, two public pension funds from Fairfax County in Virginia previously invested in the first two Morgan Creek Digital funds. They were the first public pension funds to allocate to the industry. These were venture funds that had approximately 15-20% invested in bitcoin.

The argument has always been simple. Bitcoin is a non-correlated, asymmetric asset that would allow a pension fund to make a small allocation, while still having an outsized impact on the portfolio. This was true when bitcoin was around $3,500 and it is true when bitcoin is trading around $60,500 today. Bitcoin ETF bring pension funds and institutional investors one step closer to the Bitcoin.

Why This Saga For Bitcoin ETF?

Recently USA has reported 5.4% CPI and 4% core inflation. This may lead to Corporations capitulate. There needs to be a conversation about fiduciary duty and public companies that continue to hold 100% of their balance sheet in cash and cash equivalents. They are intentionally losing shareholder value without any strategic gain. At some point, shareholders have to say enough is enough.

To be candid, Institutions are in early stages of unveiling about bitcoin and had no traditional ways to access the asset. This opened the door for a revolution led by individuals. It is one of the first times where individuals were able to front run Wall Street to get exposure. It also happened to be an asset that was in the middle of becoming the best performing asset of the decade.

We now have the benefit of hindsight, while also living in an insane time of fiscal and monetary policy. That makes the importance of a bitcoin allocation even more obvious to most institutions. It also doesn’t hurt that folks like Paul Tudor Jones are going on CNBC and saying that we have the most inappropriate monetary policy of their lifetime.

But this ETF will focus on bitcoin futures as opposed to holding spot bitcoin, which is a little different. The most interesting part about this launch is it still had a historic first day with futures-based ETF. But it’s not necessarily be available to everyone. The spot-based ETF would have been much more compelling to investors. So if the futures version was breaking records, the spot ETF would have probably blown every other ETF out of the water in terms of day one net assets and day one trading volume.

This leads us to understanding the key differences of futures vs spot ETFs.

Futures vis-a-vis Spot Bitcoin ETF

With Gary Gensler at the helm of the Securities and Exchange Commission (SEC), it appears to have decided that a bitcoin futures ETF should go ahead – as opposed to one based on spot trading. And there are some key differences between the two.

With a spot ETF, the value of the ETF will closely track the spot price of the underlying asset, in this case bitcoin. In comparison, a futures-based fund may underperform or outperform the spot price — potentially leading to a premium or discount. (In the short term the prices might diverge, but typically they will be similar over the long term.)

A futures-based ETF will involve the cost of rolling contracts that are about to expire to ones that have longer expiration dates. A spot-based ETF won’t have that cost, but it will have to pay for a custodian to look after the bitcoin – something relatively unique to bitcoin.

Both types of ETFs will likely help to increase the demand for bitcoin. For a spot ETF, bitcoin would be purchased as the underlying asset. For a futures ETF, traders will typically hedge their positions by buying physical bitcoin.

Why would the SEC prefer a bitcoin futures ETF?

A lot has been made of the SEC’s approval of futures-based funds and distaste for a spot bitcoin ETF. The thinking behind it is that there are better investor protections around the futures market.

As an ETF based on futures, that means it will be an actively managed fund. The company issuing the fund will trade bitcoin futures and the success of the fund will depend on their trading strategies.

Currently, the proposed bitcoin futures ETFs would only include long positions. That means the companies behind the ETFs would only be able to take long bitcoin positions and would not be able to take any short positions. There are other companies trying to launch inverse bitcoin futures ETFs — which are for short positions — but they haven’t been approved yet.

One important difference in the eyes of the SEC seems to be that while spot bitcoin trades on venues that aren’t regulated at the federal level, futures trade on the Chicago Mercantile Exchange, which is regulated by the Commodity Futures Trading Commission.

There are around five bitcoin futures ETFs in line to launch in the near term, with potentially two launching this week.

Bitcoin ETF: What It Means To Bitcoin?

This BTC futures ETF “will definitely cost investors’ performance,” Real Vision’s Raoul Pal said in an interview. In other words, it will be worse than holding the real thing. Inflows from the ETF will cause the Bitcoin futures price to trade at a premium to the spot price. Sophisticated investors will be able to take advantage of that difference by buying the spot and selling the futures at a profit, but the large majority of investors holding the ETF will be losing out.

In addition to that underperformance, the ETF is feeding Wall Street the same fees that crypto was built to get rid of: The ETF provider takes its fee, law firms dealing with regulators took their fees, and so did the auditors and administrators. Meanwhile, hedge funds arbitraging between the futures and the spot get to pocket those gains, Pal said.

“To do this and say, this is a good way of keeping the individual retail investor safe, is simply just not true,” he said.

The Way Forward: Getting Spot Bitcoin ETF Approved

So the new Bitcoin ETF is great. But we’re lucky to be in the vanguard of finance, where we don’t really need it. We can invest in Bitcoin directly. On top of that, we have access to hundreds of indexed funds that let investors express much more sophisticated views on the market than going long or short bitcoin based on a speculative price in the future.

And sure the whole point of the ETF is it gives access to investors who can’t (because of regulations, mandates, etc.) or won’t (because it’s hard, different, scary) access all these tokens.

An ETF based on futures is not ideal as there is a cost to rolling into the futures contracts, given contango i.e. translating into underperformance versus the underlying asset. Traders typically roll over futures to switch from the short-term contract that is approaching expiration to another contract further out in months. This rollover entails a cost.

When futures are in so-called “contango,” a term more commonly heard in commodity markets than financial futures, prices are higher in longer-term contracts than on the front end. That means as contracts approach settlement day, the ETF will have to sell lower-priced futures and buy higher-priced ones, which will erode returns every time contracts roll off.

The solution to this is Bitcoin Spot ETF. ETF that is backed directly by crypto asset Bitcoin. Cut the middle man out, which was the core philosophy of Satoshi.

DeFi Index Funds Are Already There For “Crypto Maximalists”

The long wait for this one imperfect trading product like Futures Bitcoin ETF shows exactly why DeFi will disrupt and upend traditional finance. The DeFi index funds do the same thing ETFs do. The exchange-traded fund was born out of the drive to provide investors with a way to earn returns without having to pay pricey fees to Wall Street money managers. So they’re super cheap, and ETFs trade like stocks so they tend to be highly liquid. Most importantly, most are based on indexes like the S&P 500 or the Nasdaq 100 and bellwethers for international stocks and commodities like gold and oil. By spreading bets in indexes, investors have a surefire way to manage risk.

The same applies in DeFi. No surprise in a permissionless ecosystem, there’s a lot of diversity in the offerings. You have more methodically created products by teams dedicated to providing indexed funds, like Index Coop, Cryptex Finance, Indexed Finance and Pie DAO. These projects have launched about 30 funds, with almost $1B in market cap, including the DeFi Pulse Index, TCAP Total Crypto Market Cap Token and the Metaverse Index, according to research by Arch, which is also building a suite of tokenized indexed funds.

Closing Comment

Let’s not lose sight of what truly happened this week – regulators have finally stood aside for a product that is rudimentary compared to the breakthroughs emerging steadily in DeFi. The focus should be on getting more people using the future of finance. The rest is just window dressing in a falling house.

Related Blog Post: Are You Ready For DeFi Crypto Winter?

Sponsored

Earn HNT Token Daily With FREE Helium Miner? Grab Yours Now

Start Earning Passive Cryptocurrency with Helium Hotspot Mining. Start Your CRYPTO Passive Income Now!