“The Flippening”

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

I was thinking about the historical events of the flippening. Netflix flipping Blockbuster. Amazon flipping eBay. eBay had a market cap of $77 billion in 2004 drop by 50% currently. Amazon’s market cap of $18 billion in 2004 is worth over 8,775% more now. Amazon, adapted to new market demands and planned for growth while the other company, eBay, remained focused on a rigid platform with no broader vision. Now I would like to tie this to “Bitcoin Flippening”.

As an extreme thought, will Bitcoin taper off and become the Blockbuster to Ethereum’s Netflix? The first mover that refuses to quickly adapt to new technology and eventually goes bust? Will Bitcoin share a similar fate as eBay did after it enjoyed a short-lived moment of dominance over Amazon in the early days of the internet.

Let us dive in…

Crypto markets are generally choppy and so the volatility in crypto markets. As the retail crypto market started hitting the bottom, the institutions jumped in to accumulate crypto assets, providing upward demand pressure. On June 1, a breaking report by Cointelegraph brings tremendous evidence to this claim of increasing demand from traditional institutions.

But the retail crypto market is not resting anytime soon. 2021 survey conducted by “Financial Planning Association” found that 26% [compared to <1% prior to 2020] of financial advisers indicated that they plan to increase their use/recommendation of cryptocurrencies over the next 12 months. This results in remaining ~74% of advisors who are inevitably going to be late to the game. Wouldn’t it be good for those who are owners of these scarce, valuable, productive assets?

With renewed interest of retail investors combined with institutional demand, it appear to be far less concerned with market volatility this year compared to last! It seems people are beginning to trust the process of crypto investing, and thus market capitalizations remain steadily growing on a long term basis.

Bitcoin Flippening

All this is leading to an environment where altcoins will continue to outperform Bitcoin for two reasons. First. there is a significantly large “marginal buyer” entering the market. The positive price action in Bitcoin and altcoins will be driven by the price incensitive institutions who very clearly are expressing their plans to grow their crypto portfolios over the next few years.

Second, the long-term value of the DeFi Pulse Index, which is a market-cap-weighted index for only DeFi coins, has been growing very rapidly in terms of US dollars and Bitcoin. This means that the sector of DeFi coins, on average, has grown even faster than Bitcoin during this recovery. The DeFi Pulse Index and its allocations are shown below. DPI is an awesome way to gain general market exposure to an entire specific sector.

Now, look at the next price performance charts 1Y and YTD of BTC vs ETH vs DPI. CLearly DPI and ETH performance is consistently better than BTC.

Now let’s analyze the DeFi Index against BTC in terms of market capitalization and see the flippening trend being notoced recently. This is a reliable reversal pattern, when spotted on higher time frames like we are seeing now. This implies that the market is supporting this current “price” and market cap of DeFi coins relative to Bitcoin.

We can interpret this to generally mean that the market thinks DeFi is a good deal! Moreover, this strength is a very good sign that there is still a strong risk appetite, which is necessary for an altcoin bull market. This actually might be more bullish now than we have been since December 2020.With the continued excitement in the institutional landscape, record inflows into crypto hedge funds across the globe, and retail investors are becoming much more active.

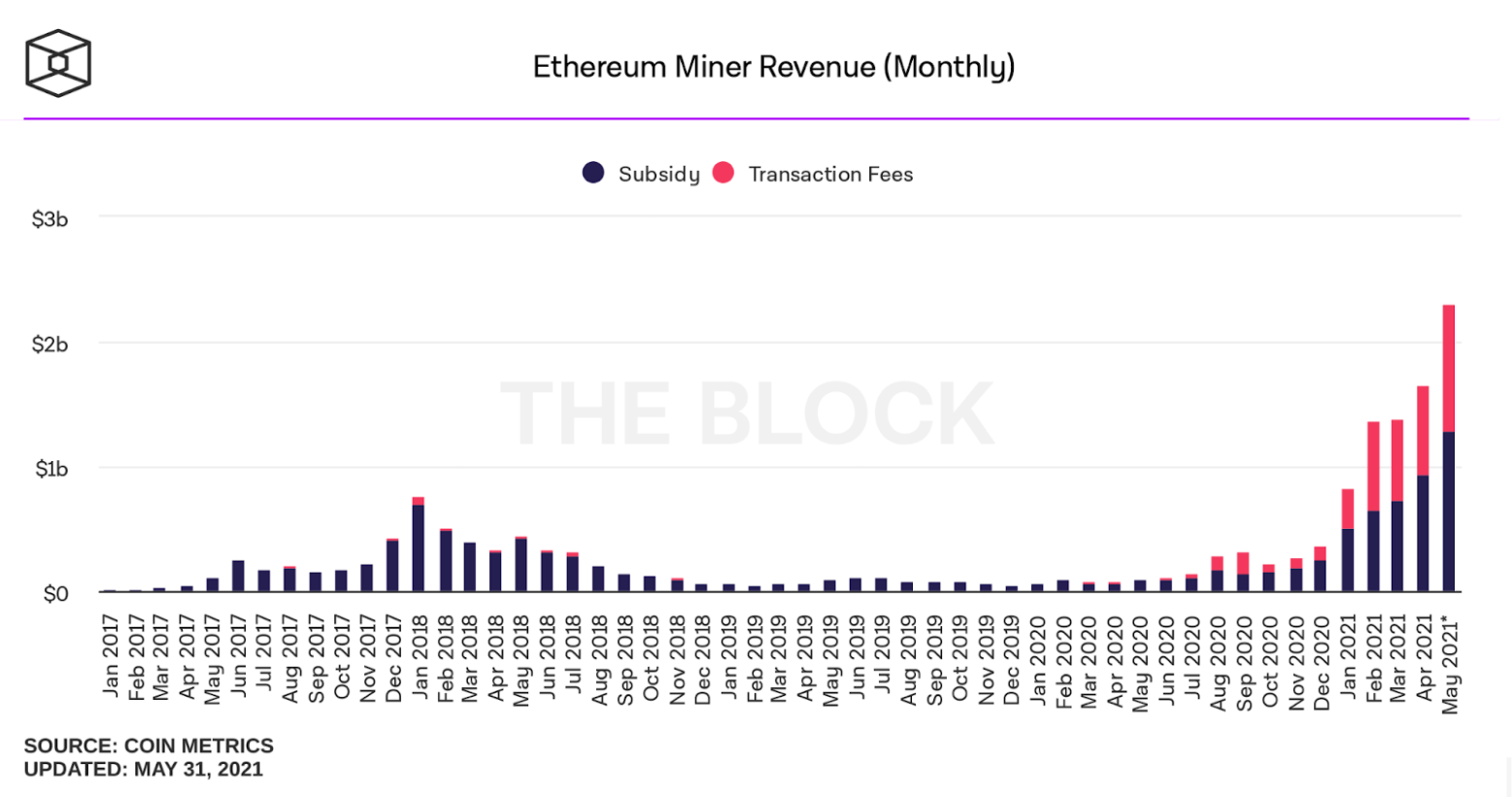

This long-term bull market in the DeFi ecosystem still feels far from over for a few reasons. From a relative valuation perspective there seems to be far more activity in DeFi than BTC alone. Is this an indication to Bitcoin Flippening? Taking a look at Ethereum – which is the main hosting platform for DeFi currently – it has wildly increasing revenue going towards miners (below). This signals increasing demand as people are willing to pay a higher price to get their transactions processed faster. Traders are quite literally bidding up the price of digital gas

This chart shows that in May 2021, the monthly income of Ethereum miners reached $2.31 billion, of which transaction fee income was $1.03 billion. The transaction volume and number of active addresses of the Ethereum network in May reached a record high! This is data according to TheBlockCrypto, and Coin Metrics.

This being said, you can rationalize a future where Ethereum could make a play for Bitcoin’s market capitalization– meaning that it could surpass it. This possibility has been commonly referred to in crypto circles as “The Flippening.”

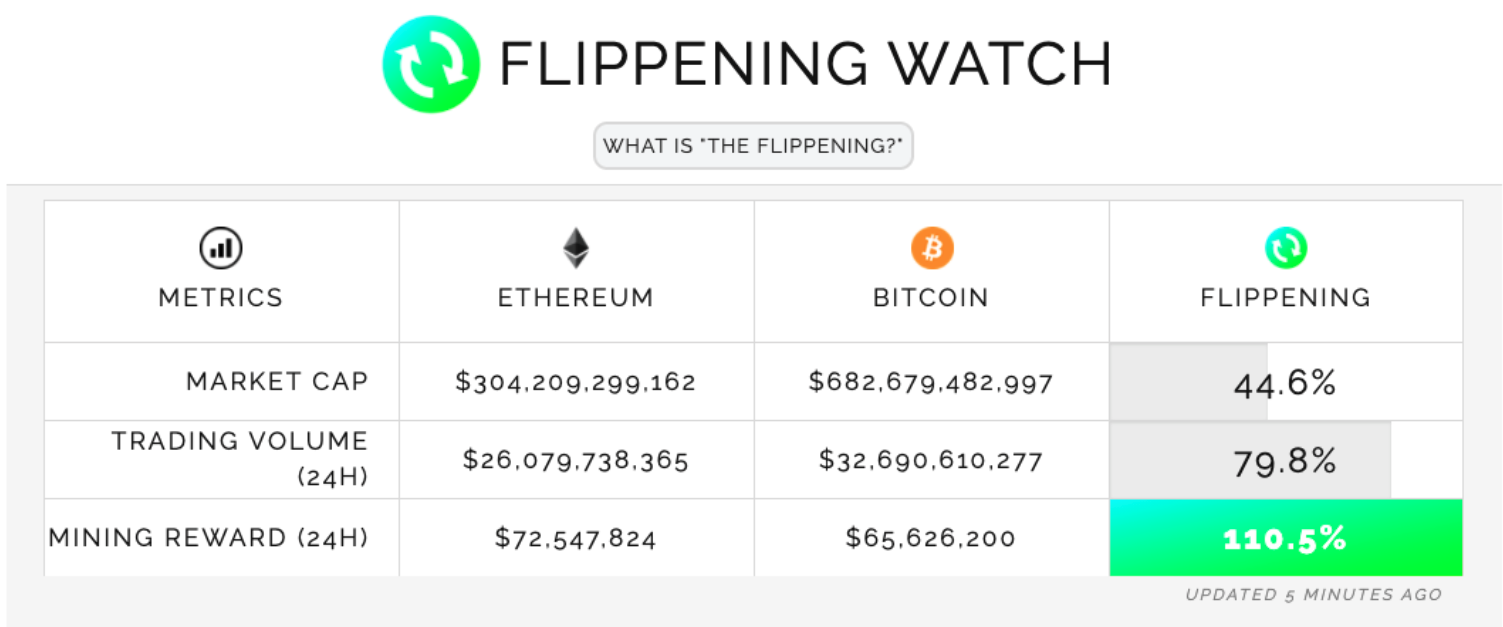

Currently Ethereum is around half of Bitcoin’s market cap. This Website called Flippening Watch has a nice series of visualizations to track this potential event.

Is Bitcoin Flippening inevitable? Not saying this is the case here with Ethereum certainly becoming the dominant player– rather, just a posing thought experiment to bear in mind. Anything is possible. Just like nobody could have predicted Amazon’s rise relative to eBay back in the early 2000’s, or even as early as 2012 when Amazon finally broke the $100 billion mark while eBay struggled to hold onto $70 billion, nobody can predict where the top is for this current market.

The flippening may not be permanent and in ll probability Bitcoin may regain its top position. Be prepared for the bitcoin flippenning just in case! Purely from the point of view of the market opportunity!!

Sponsered

Join The Crypto Swap Profits Mastermind Today!

Window Of Opportunity – How To Take Advantage Of The New Crypto DeFi Surge Before It Passes You By

In The Money Stocks

Live, Actionable Trades In Stocks, Commodities, Currencies, Options, CryptoVerified Track Record For Over 14 Years! Documented 80 – 90% Success Rate Unparalleled In The Industry

Recommended Reading

Cryptoasset Inheritance Planning: A Simple Guide for Owners

“What happens to my bitcoin, ether, or other cryptoassets when I die?”

Cryptoasset Inheritance Planning: A Simple Guide for Owners by Pamela Morgan, Esq., is a clear blueprint to inheritance planning for those holding cryptocurrency, tokens, crypto-collectibles, and other cryptoassets. Since 2015, Pamela has educated thousands of cryptocurrency owners around the world about why inheritance planning for cryptoassets matters and how to do it in a secure, usable, resilient, and efficient manner.