An Easy To Follow Guide To Capture “Crypto Alpha”

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

A term borrowed from the traditional markets is “alpha”, which is the mythical metric constantly chased by participants in capital markets. Conceptually, alpha is used to quantify the excess returns of an investment strategy relative to the standard market benchmarks. In this blog post, I’ll attempt to offer easy to follow steps to capture ‘Crypto Alpha”. Let’s dive in!

Etherscan Crypto Alpha

Etherscan is one of the most useful tools out there but it’s intimidating. You can find real-time alpha and 100x gems with Etherscan. Etherscan is really useful but most people don’t know how to use it correctly. Here’s how you can find crypto alpha with Etherscan.

Gas tracker

Etherscan’s gas tracker is really useful. Ethereum gas can get really expensive. The cost adds up. You can view current gas prices on Etherscan, and choose one that fits your needs best. You can try to estimate the lowest price for a transaction with this info.

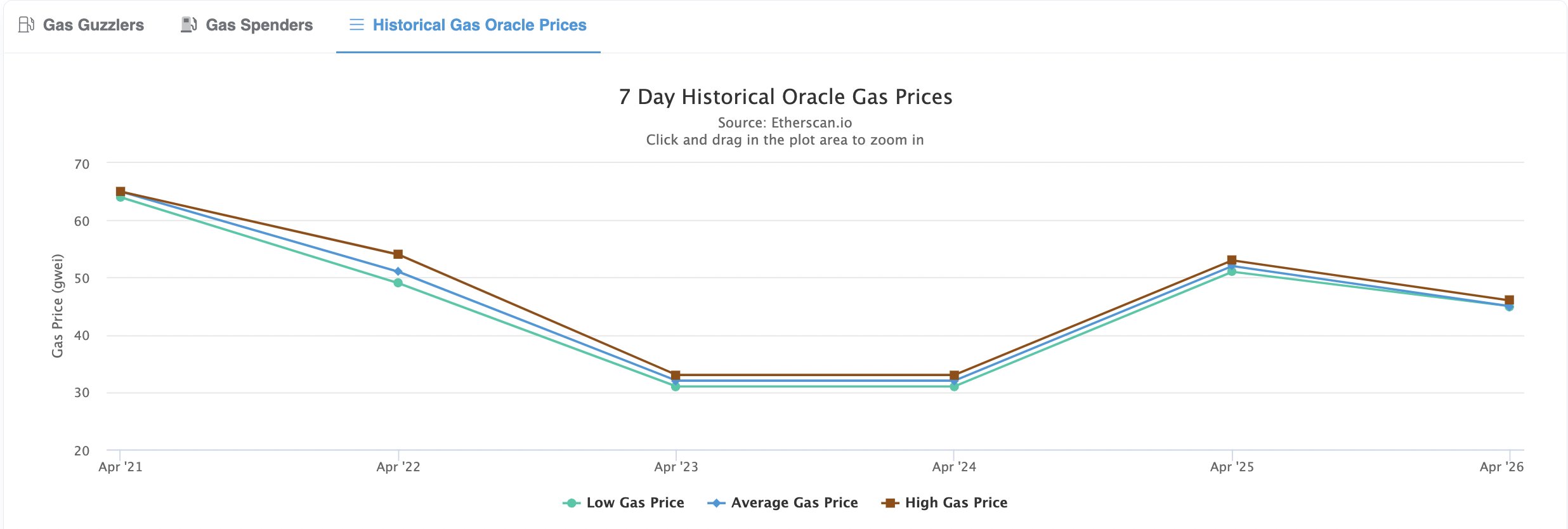

Etherscan also displays gas price history. Based on the 7 day gas price graph, we can see that the lowest gas prices for the week are around 12 gwei.

This is really useful when your transaction isn’t time sensitive. I would set my gas price to around 15-20 in this case. Most wallets let you set your gas prices when you make transactions You can find the Etherscan gas tracker here: https://etherscan.io/gastracker

ERC-20 tokens

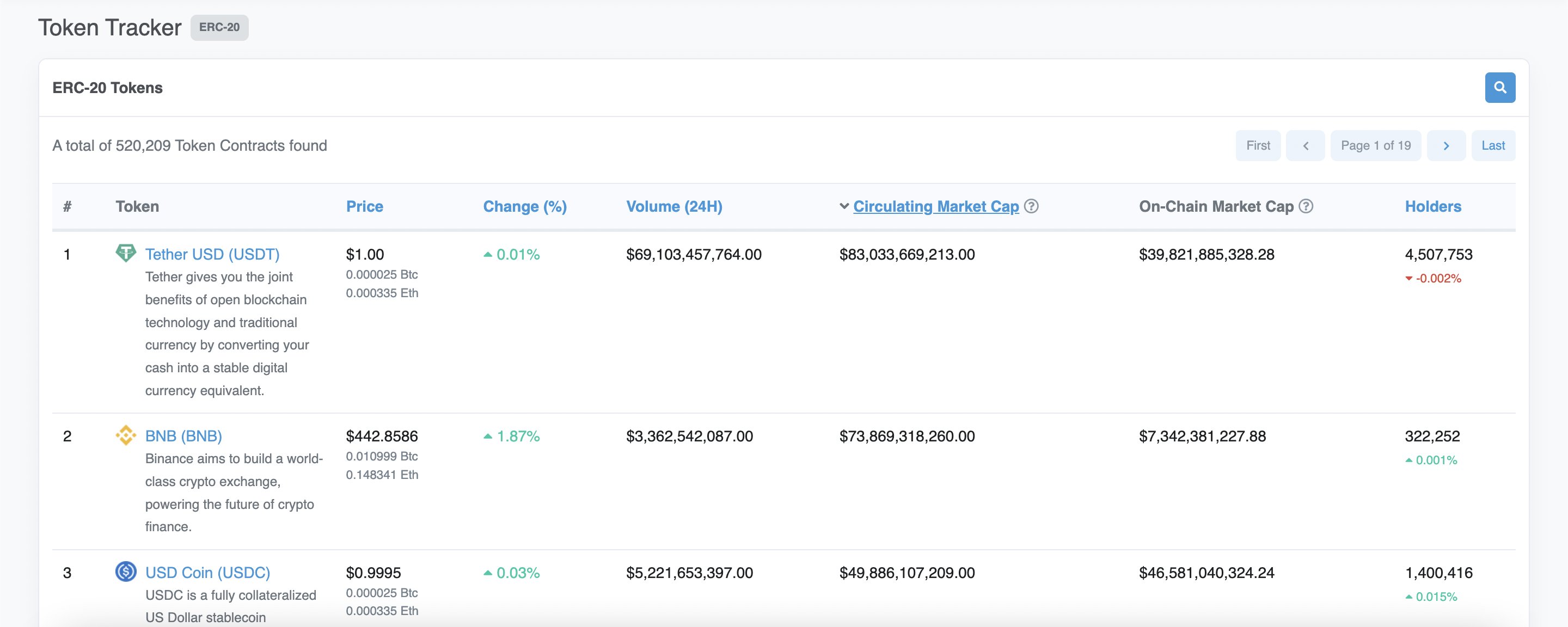

Etherscan has info on pretty much any ERC-20 token. You can easily access key data like market cap, volume, and number of holders.

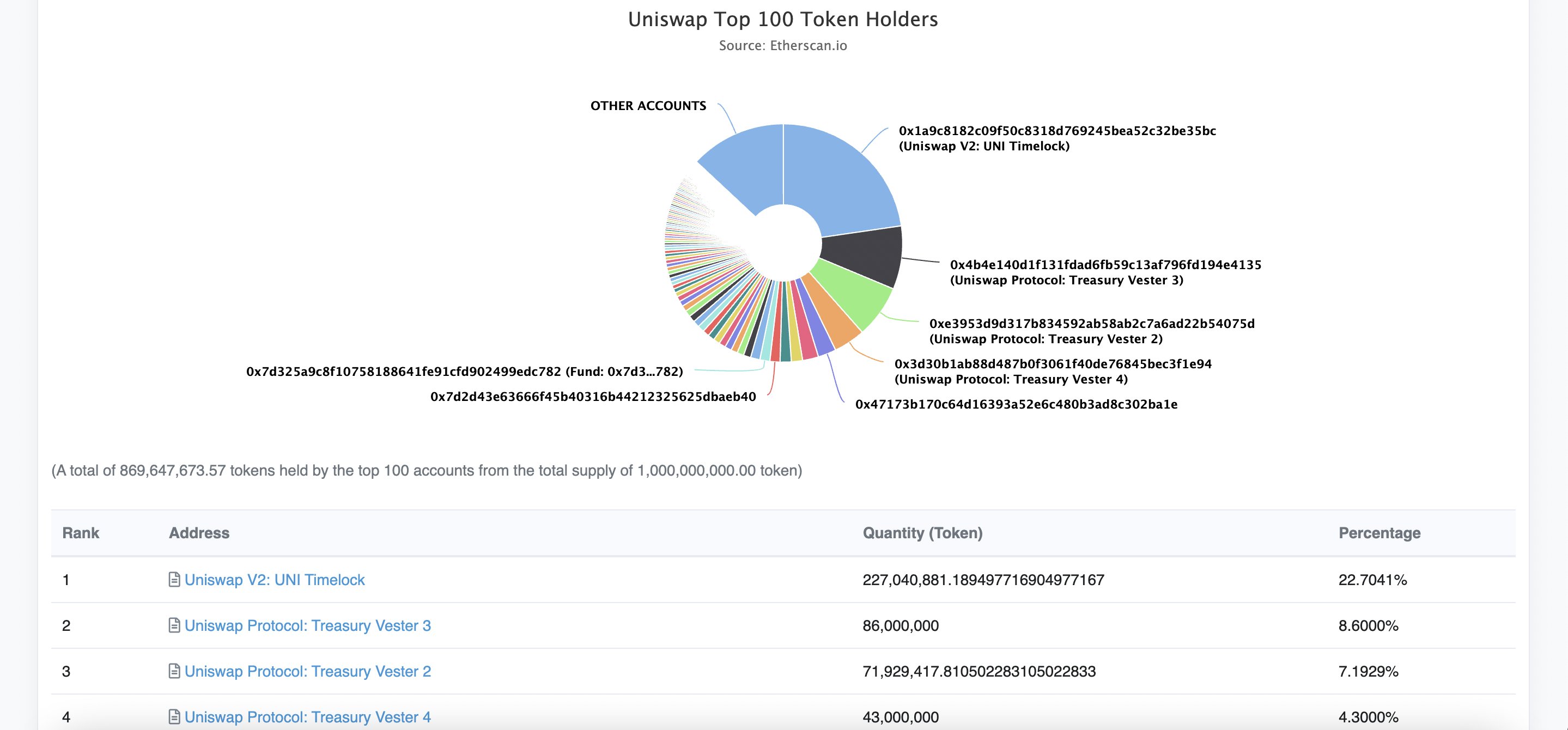

You can easily view how much money is going in and out, as well as the change in holdings. Here you can see the holder breakdown for Uniswap.

Wallet Tracking

Wallet tracking is one of Etherscan’s best use cases. You can follow whales and smart money. You can see which transactions occurred as well as when.

Etherscan lets you filter tx history by address for any ERC-20 or NFT you wish. This can even get broken down to transactions including only specific to/from addresses.

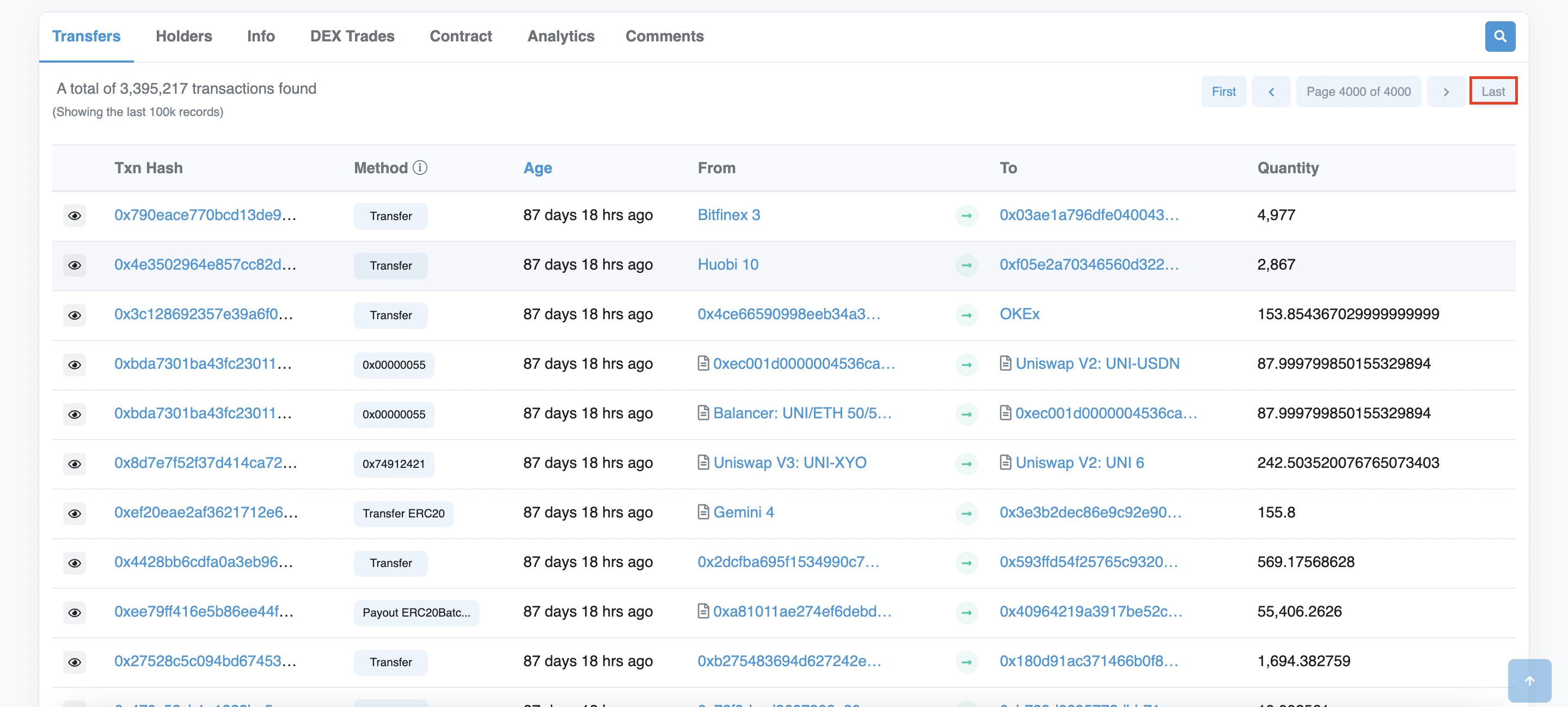

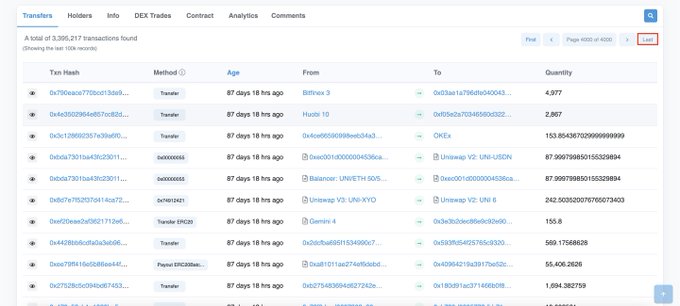

A great strategy to find good wallets to track is to look at wallets that got in big positions early. They might be good at identifying tokens early. To do this look through the transfer history and sort by last.

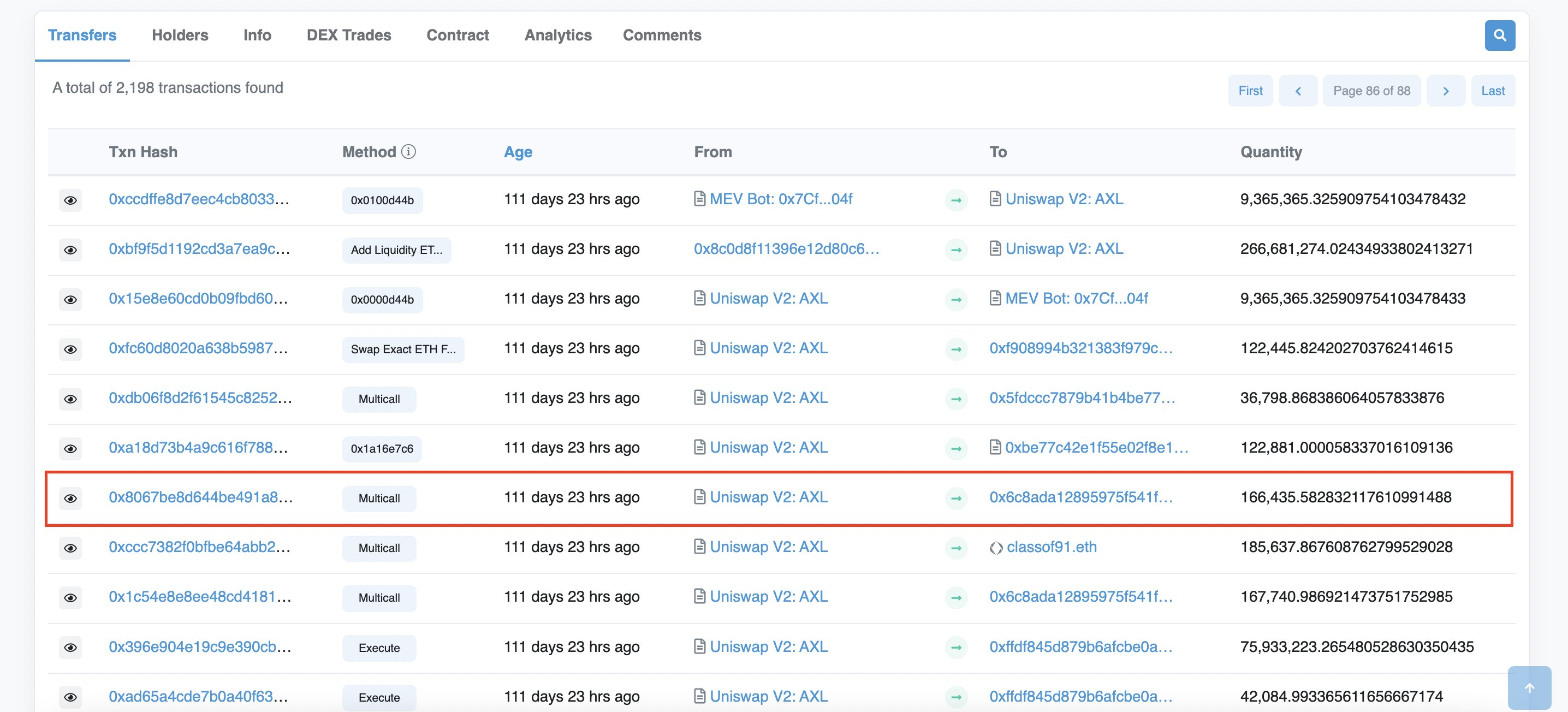

Look for wallets that bough a lot early. Let’s do this for AXL. This sale looks interesting. This account bought 166k AXL tokens just a few weeks after the initial sale.

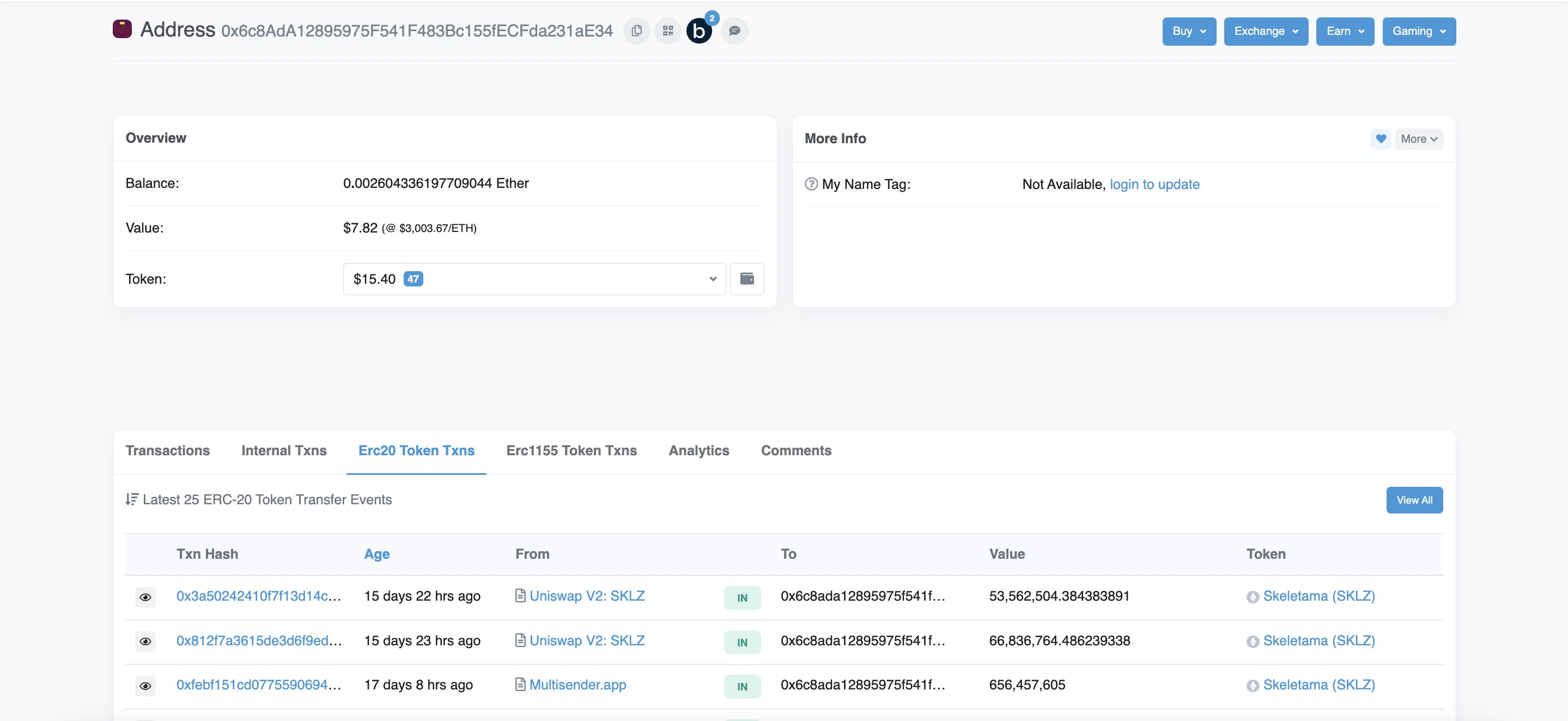

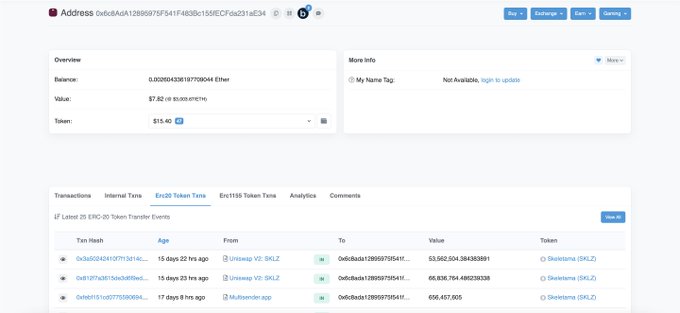

View the address in the block explorer. The main page for an address has some useful sections:

- Txs: historical tx row + method called on each

- Internal txs: contract interactions

- ERC-20 txs: latest token txs

- ERC-721 txs: latest NFT txs

- Analytics: wallet stats

t’s a good idea to see if this person has a history of making winning plays. Look through their ERC-20 transaction history and see if they’ve had success in the past. If so, they’re likely worth following.

NFT transactions

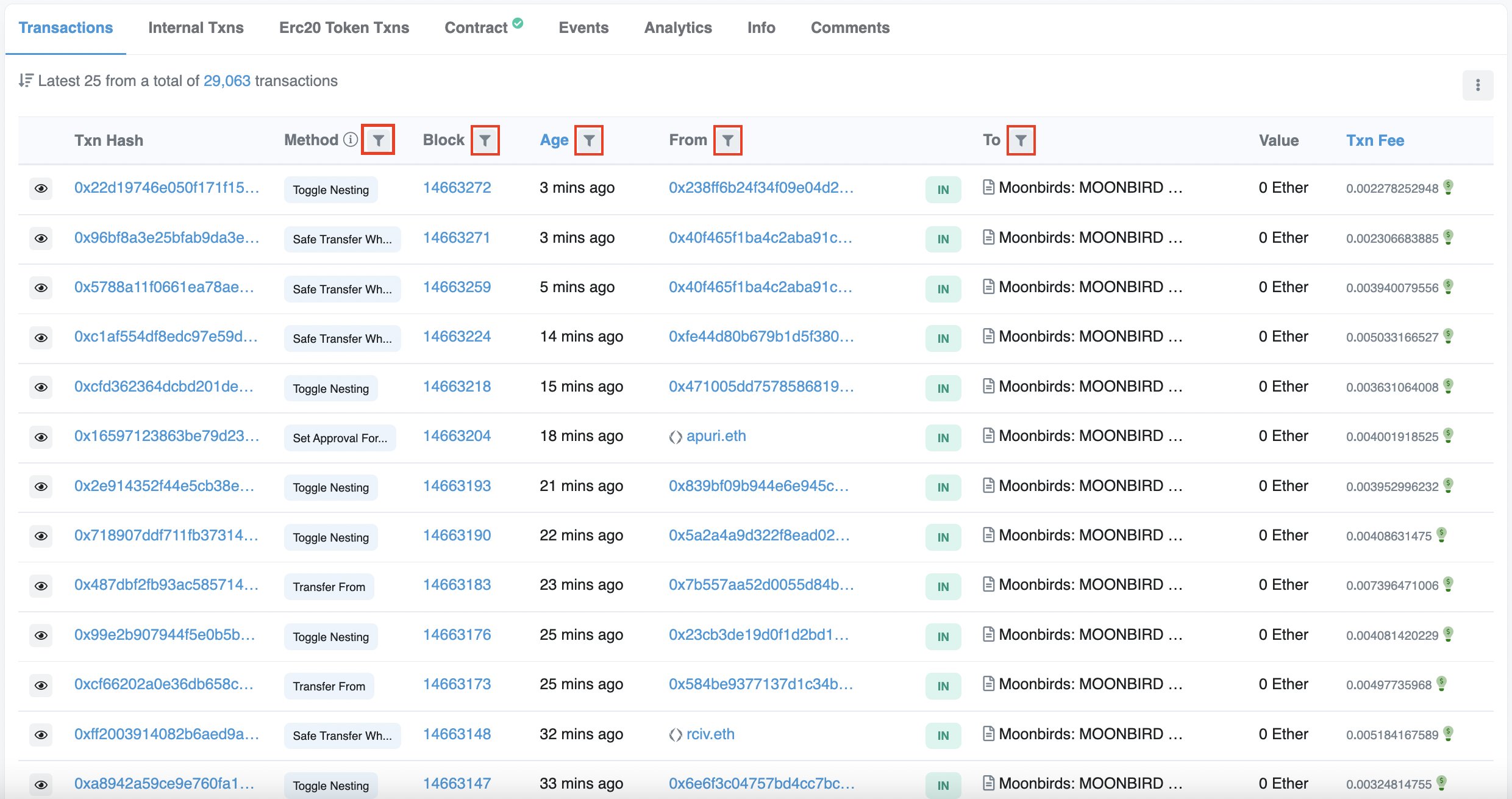

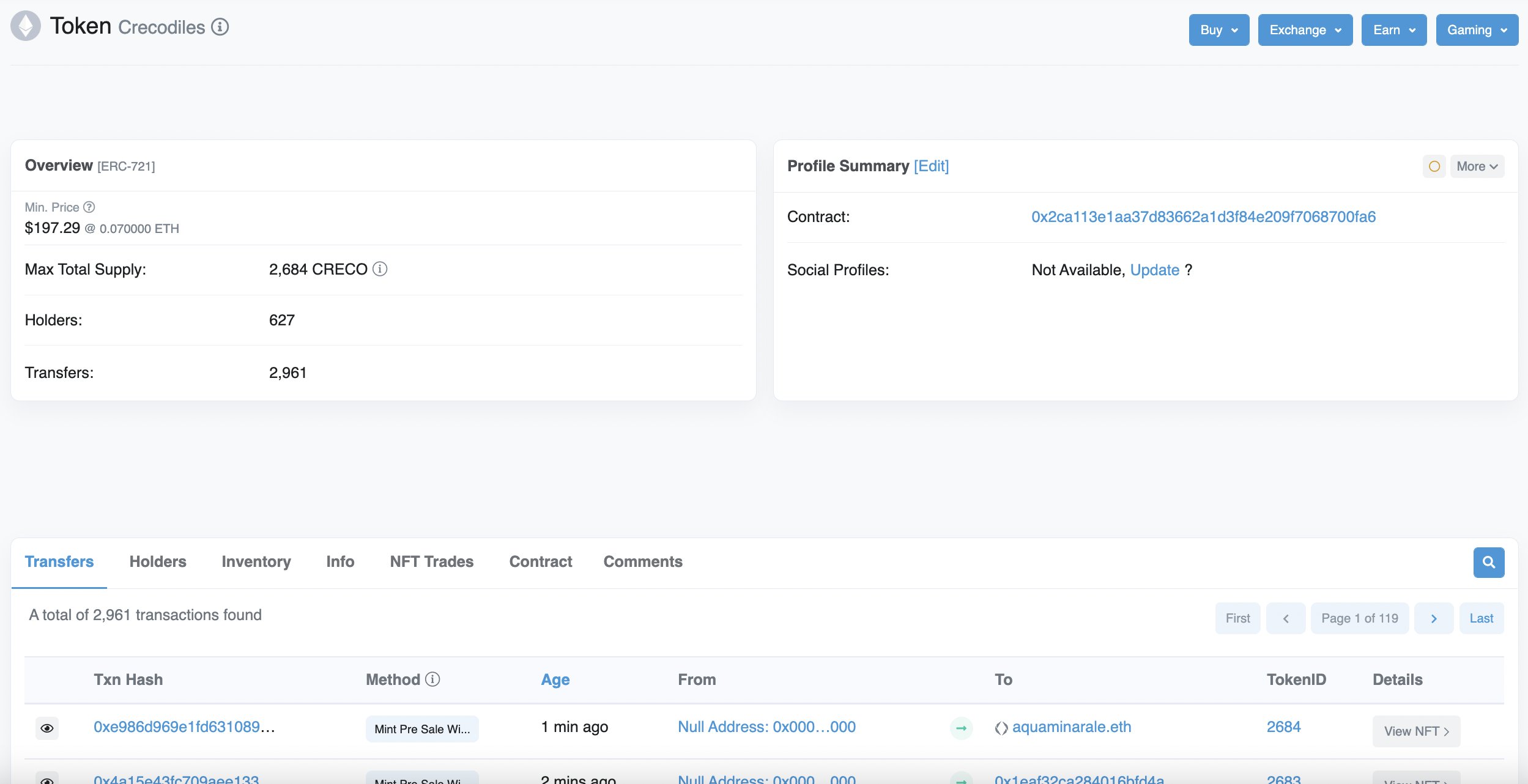

You can track NFT transactions including mints on Etherscan.

You can click on the token address of a project to view more information about it. Similar to the ERC-20 token breakdown, you can view useful information about an NFT project.

You can look at holders, transfers and more. This makes it easier to gauge how well an NFT is doing or will do. You can find the NFT tracker here: https://etherscan.io/nfttracker

Making Transactions

Crypto and more specifically DeFi Dapps are often buggy. The UI normally takes time to update, and these apps often don’t work for hours on end.

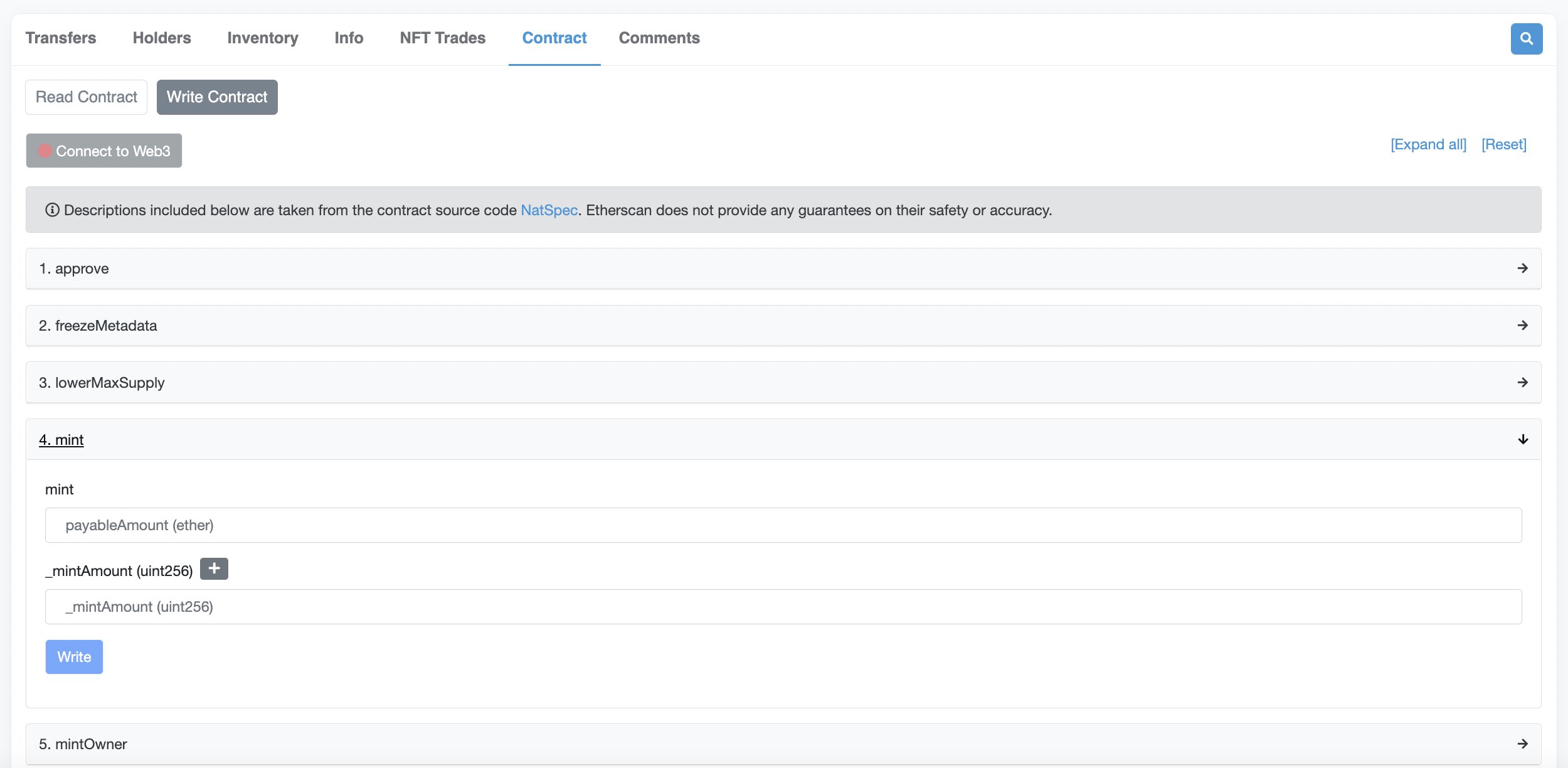

You don’t have to wait. Etherscan provides a simple interface for making transactions on different smart contracts, for any connected wallet. Just go to the contract page and you can select write contract.

Smart Contract Search

Etherscan’s smart contract search feature is really handy. You can use it to find information about specific tokens before anyone else does. It’s possible to find answers to questions like: what contracts use this token?

You can find the Etherscan smart contract search here: https://etherscan.io/searchcontract

Reading Contracts

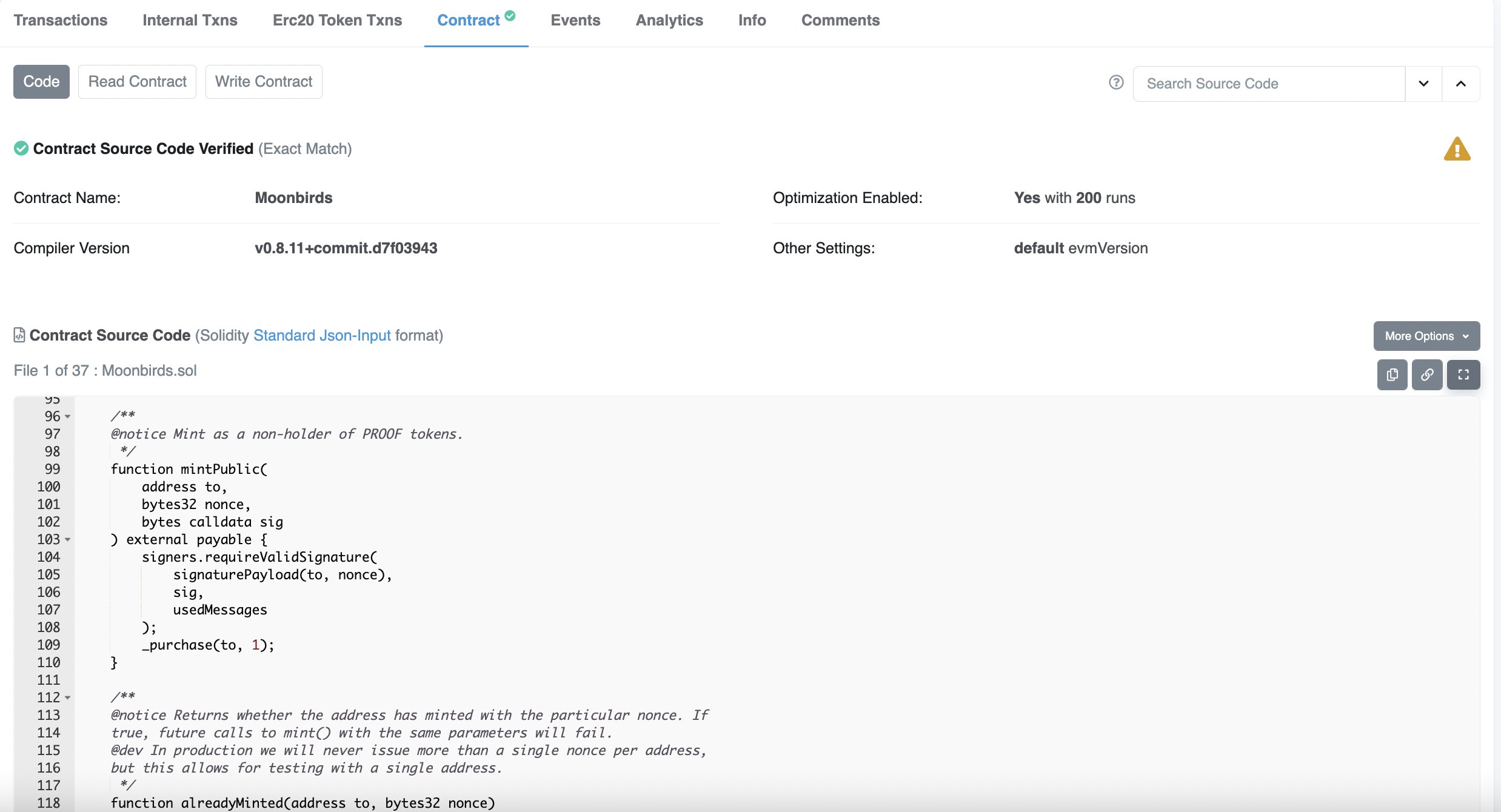

You can read the source code of any smart contract. This is under the contract section of the smart contract. This can be useful if you have experience reading code and want to take a closer look at a project. Here I’m looking at the Moonbirds contract.

When you’re looking at smart contract code, you can change the url from “.io” to “.deth,net” This opens a deployment ready directory window in visual studio. You can view and edit the contract you were looking at here.

Etherscan can be intimidating, but if you master it you’re going to have a huge edge. It’s one of the best ways to find alpha

How To Track Crypto Whale Movements To Uncover Crypto Alpha?

Whales have all the alpha. They’re always a step ahead. With the right tools, we can see everything whales do. This information can make you rich.

A whale movement is a large cryptocurrency transaction. It’s a simple signal that can have a colossal effect on the price of a cryptocurrency. Here are few wahle moments to watch for (Each of these have different price signals. It’s important to know how to identify these):

Types of whale transactions

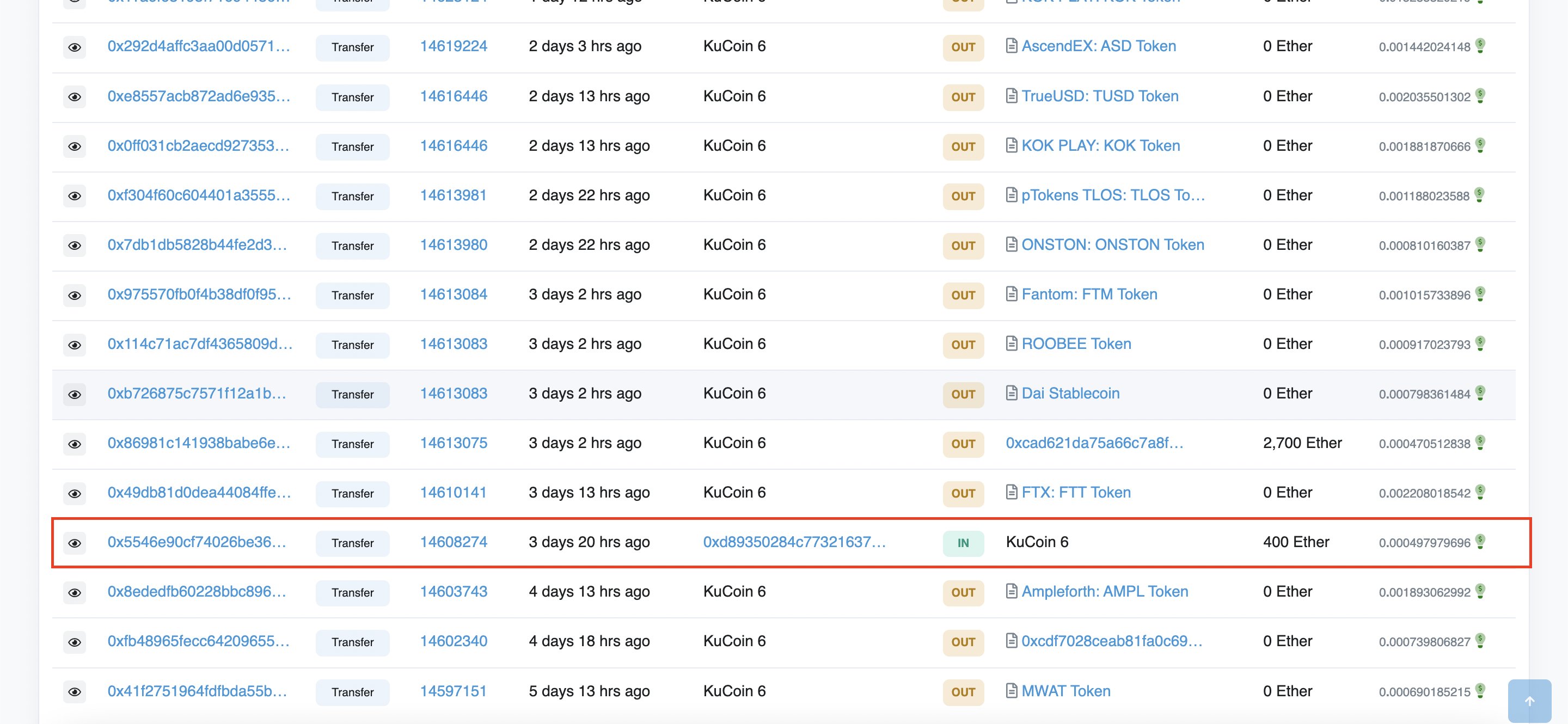

Exchanges are fairly easy to identify on Etherscan. They’re usually labeled. In the picture below 400 ETH is being sent to kucoincom.

When you see a that cryptocurrency is being sent from a regular wallet to an exchange wallet, it usually means that someone is about to sell.

Hundreds of millions of dollars of a cryptocurrency being sent to an exchange could greatly add to the sell pressure and even crash the price of a token.

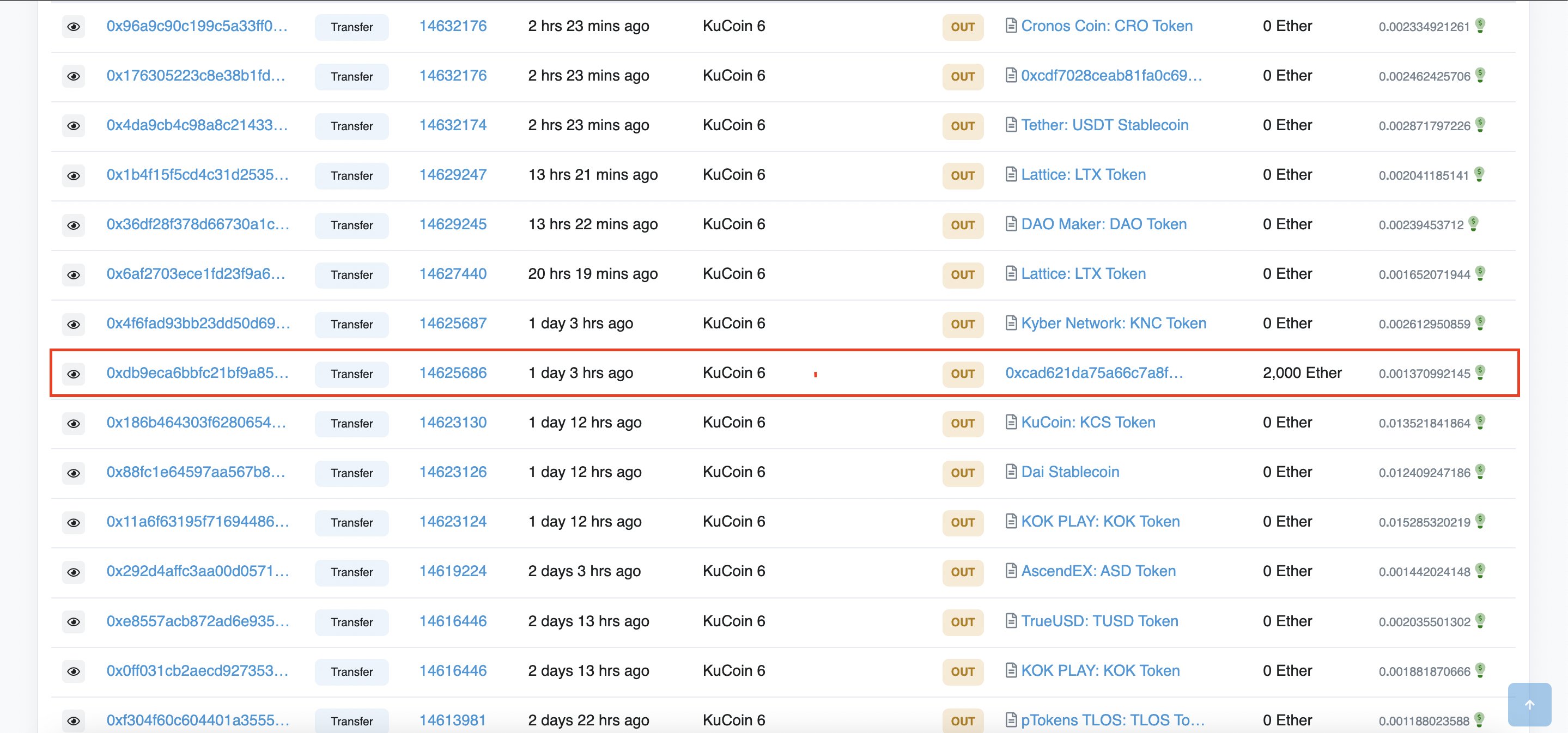

Sending Crypto to a wallet from an exchange In the picture below 2000 ETH is being withdrawn from KuCoin. As expected, moving crypto off of an exchange creates upward pressure on price.

Whales are less likely to sell if they’ve just moved their holdings off an exchange. Enough whale movements off exchanges and into wallets for a specific cryptocurrency can cause a sudden reduction in market-ready supply. This can even be rocket fuel for positive price action.

Wallet to wallet transactions: Some whales don’t like exchanges. The large amount of crypto they’re looking to buy or sell could stir up the market.

They often do Over the Counter Trading (OTC). This allows big investors to buy or sell large amounts of cryptocurrency directly from an exchange or cryptocustodian at a fixed price.

Wallet to wallet transactions are a red herring. These transactions don’t typically influence the market significantly. Moreover, it’s impossible to know who’s buying or selling until it’s too late.

Keeping up with whale transactions: One of the best ways to keep up with whale movement is through @whale_alert. It’s a great account that notifies you about large transactions.

Market Depth

What size transactions should we be looking for when we’re tracking wallets? This depends on something called market depth.

Market depth tells you how much money is required to push the price of a cryptocurrency up or down on any given cryptocurrency exchange. The more money it takes to push up or push down the price the greater the market depth that crypto has.

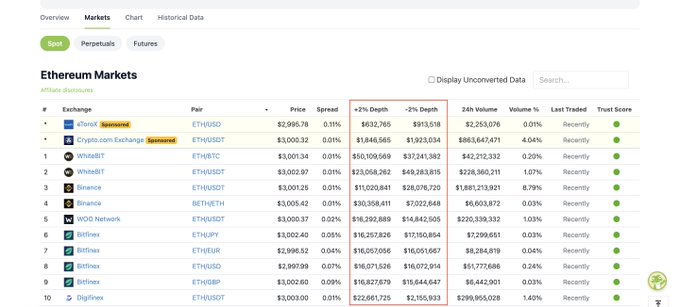

You can easily check a coins market depth under the Markets tab on CoinGecko or CoinMarketCap. In the picture below you can see the market depth for ETH by exchange. It shows how much ETH needs to be bought or sold on a given exchange to push the price up or down 2%.

Market depth is important when considering how a whale movement will affect price. If you see 10 million dollars worth of ETH being transferred from a wallet to an exchange with a market depth of 20 or 30 million dollars to the downside, then the effect on price could be negligible.

But most altcoins have much lower market depths in the millions or even less. A 10 million dollar whale movement would have a huge effect on the price here.

Finding wallets to track

Etherscan and @DeBankDeFi are two really great ways to find wallets to track.

You can use Etherscan to research any ERC-20 altcoin. You can easily access key data like market cap, volume, and number of holders (as shown above).

A really bad sign is when a large percentage of tokens are sitting in exchanges. A lot of top holders are getting ready to sell.

A great strategy to find good wallets to track is to look at wallets that got in big positions early. They might be good at identifying tokens early. To do this look through the transfer history and sort by last.

Look for wallets that bough a lot early. This only works for relatively new coins though as Etherscan only keeps track of the last 100k transactions. Let’s do this for AXL. This sale looks interesting. This account bought 166k AXL tokens just weeks after the initial sale.

View the address in the block explorer. It’s a good idea to see if this person has a history of making winning plays. Look through their ERC-20 transaction history and see if they’ve had success in the past. If so, they’re likely worth following.

Finding wallets on @DeBankDeFi is really simple. DeBank ranks top ERC-20 wallets. This is a great place to get started.

You can look at their holdings and recent transaction history. Any coins you find interesting might be worth looking into. It’s also worth looking at their address in Etherscan to identify how much success the account has had in the past.

Tracking and analyzing wallets

Most altcoins are heavily correlated to Bitcoin. A Bitcoin whale movement could crush your favorite altcoin. Everyday we see a few whale movements for blue chips. Some of these are large, a few of them are massive and they have a predictable effect on price.

One thing that’s rare is an old Bitcoin wallet making a transaction for the first time in a long time. These transactions could shake up the market. They usually make crypto headlines as well.

When you’re analyzing wallets, keep in mind the tokenomics of the cryptocurrency and which whale wallet the transaction is coming from.

Someother Crypto Alpha Tools

Pro Alpha hunters use the best tools available. Here’s a list of my favorite tools to hunt for alpha.

Messari: A leading crypto-research and market intelligence group. They post detailed research about DeFi and Crypto. messari.io

Delphi Digital: An in-depth research platform dedicated to crypto and digital assets. They have a lot of great articles and insights. https://members.delphidigital.io

LunarCrush: Let’s you look at social metrics and sentiment analysis for cryptocurrencies. If you’re looking to flip tokens or get into shitcoins, social sentiment is really important. https://lunarcrush.com

Nansen: One of the best on-chain analysis tools. There are a lot of useful tools, like their token god mode. It’s expensive, but will be worth the price for many people. https://pro.nansen.ai

Coindix: keeps track of the best yield opportunities across DeFi. It’s a really great way to find out about yield farming opportunities. Always DYOR though. https://coindix.com

DeBank: A great tool to visualize Ethereum wallets. You can look at the most popular wallets and get a better idea about how their portfolio is allocated. https://debank.com

DeFi Lama: A lot of useful tools. You can keep track of upcoming airdrops. Airdrops are a great way to earn free money on your crypto, and this way you won’t miss out. https://defillama.com/airdrops

Icy Tools: A platform where you can view trending NFTs. You can view metrics about NFTs and keep track of useful info like sales and volume. You can keep track of collections that you’re following and notable NFT wallets. https://icy.tools

In Summary…

Crypto is reimagining many of the core concepts related to the creation of alpha traditional capital markets. The unique characteristics of crypto translate into sources of crypto alpha that we haven’t seen before. While the traditional methods to quantify alpha don’t directly apply in the crypto space, the new market offers completely asymmetric forms of alpha across all layers of the stack.

Go for Crypto Alpha!

Recommended Reading: Dan Hollings “The Plan”: A Best Opportunity To Benefit From Crypto Wiggles

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.

Sponsered

Start Earning Passive Crypto with Helium Hotspots. Check It!

Earn FREE HNT Tokens Daily with Helium Hotspot. Start Your CRYPTO Passive Income Now!

The Crypto Wiggle Report & FREE Training

Greatest Financial Event Ever?

Free Webinar Reveals How To Exploit “Micro-Fluctuations” In Crypto To Make 100’s Of Tiny, Profitable Trades Every Single Day – On Autopilot!

Predictable Profits From Less Than A Couple Minutes Of “Work”

Enroll For The World’s Most Popular Cryptocurrency & NFT Training Program, with Members in 124 Countries (FOR A LIMITED TIME ONLY)!. >> ENROLL N OW