Crypto IRA : Smart Way To Tax Free Wealth Accumulation

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

In my journey with Bitcoin since 2016 combined by continuous learning on revolutionary crypto markets, I’m kinda of look beyond the boom and bust cycles, and developed a tunnel vision on longterm crypto wealth creation. I introduce and highlight one such longterm approach to not only accumulate crypto wealth but with 0% taxes. Yes, I’m talking about Crypto IRA.

But first, current market scenario. While crypto markets experienced a ~25% rally following the January Fed meeting, the asset class has since retraced those gains with the broader risk asset sell off. Bitcoin has been especially resilient, rebounding from a 12% drop within 12 hours on news of Russia’s invasion of Ukraine. The near-term geopolitical situation continues to unfold and the market response remains fluid.

Before I go any further on Cryptocurrency IRA and in particular Bitcoin IRA, let me lay the foundation with a logical perspective on the merit of accumulating Bitcoin in the first place. Follow me on the analysis done by many experts…

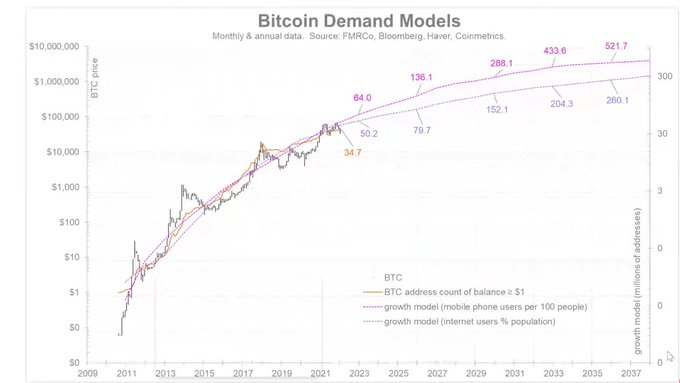

We all know the supply cap of 21 million on bitcoin by now. Let’s take a peek on demand side. The following chart represents a simple power regression on time series for bitcoin adoption that overlays mobile and internet adotion rates. Bitcoin has an exponential network growth potential that could potentially multiply the value of it alongside.

Now let peek into network growth of Apple. The folowing chart depicts that Apple’s network has grown 53X since 1996, where as the market cap is inreased by 1699X. So network value has growth 32X compared to actual network growth.

COmbine the above data with Apple’s price to sales ratio that is 30X during the same period. Take a look at the Apple stock price that skyrocketed 1457X. That is the power of the network growth on real price of the stock.

Taking Apple’s analogy to Bitcoin and price to network ratio. Bitcoin network has grown 867x since 2010 and Bitcoin price is increased by 640,633X.

Now look at the Apple and Bitcoin chart together. If bitcoin repeats the same network growth trajectory, its price is positioned to further exponential jump to $100k+ in near future. This is what making the case for accumulation of Bitcoin.

Buy and HODL, trade and periodic portfolio rotation/rebalance, bitcoin mining, or derivatives are some of the ways to accumulate Bitcoin, so as the retiremmet accounts.

Benefits of Crypto IRA

The IRS treats cryptocurrencies similar to property. With the right IRA account, you can save big on capital gains taxes.It’s important to note…Every time you trade between cryptos — such as from Bitcoin to Ethereum — that’s a taxable event. With the right IRA account, you can trade between cryptos without triggering those taxable events.

3 Ways To Gain Exposure

There are three main ways to gain exposure to cryptocurrencies in an IRA. They range from simplest to most difficult. Like all things, there are trade-offs.

The first is the simplest.

Option A: Buy a Crypto Ticker

Though it’s hardly the most ideal option…

You can gain exposure to the crypto markets right now without setting up anything fancy.

In this scenario, you just buy a ticker with your current broker. This is the easiest — but most indirect — way to gain exposure to crypto in your IRA.

For example, since Microstrategy (MSTR) is a major holder of Bitcoin, you could simply buy that.

Or if you wanted to get exposure to crypto mining, you could snap up some shares of Riot Blockchain (RIOT), or Marathon Digital Holdings (MARA), or Hut 8 Mining Corporation (HUT).

There are also “pick and shovel” plays like computer chip company Advanced Micro Devices (AMD) or Canaan Inc. (CAN).So that’s your first option.

Pros: Easy. No need to sign up for anything new for most people.

Cons: Higher fees. You don’t have direct exposure to the underlying crypto assets. These stocks don’t track the market price of cryptos.

Option B: Self-Directed IRA through Custodian

Most people gravitate toward option two — the Self-Directed IRA — if they want direct exposure to crypto in their IRA.

A Self-Directed IRA (AKA, “SDIRA”) allows the investor to diversify his or her savings beyond Wall Street into assets like real estate, private placements, and cryptos.

This is an oversimplification, but the sign up process is usually straightforward:

A.] Open up a new account at custodian

B.] Choose account type (Traditional, Roth, SEP)

C.] Transfer/rollover funds to new account

D.] Buy digital assets on custodian’s platform.

Pros: Direct exposure to crypto assets without the headaches and complexity of self-custody.

Cons: High fees. Limited offerings.

Option C: Sovereign Self-Directed IRA

Option three takes the most work and responsibility… but has the most benefits.

It’s often called a “checkbook control IRA”.

Checkbook control is the maximum amount of flexibility possible in a retirement plan. If you want to stay true to the crypto ethos, this is the model for you.

Under this structure, you move your IRA money into a bank account, giving you direct control and sidelining your custodian. This means you have more flexibility and no longer need custodian consent when making an investment. Therefore, there are no delays.

(Given that the IRS requires all IRAs to have an approved custodian, you can’t get rid of the custodian completely. But this model grinds all of your custodian fees down to a bare naked minimum.)

You’ll be able to access 100+ cryptos (through major exchanges like Coinbase or Gemini) while maintaining full custody of them… and eliminating capital gains taxes.

Again, there are trade-offs. Checkbook control is far more complex and takes way more work to set up and maintain. Be prepared for a lot of paperwork. (But there are services that can hold your hand through the process.)

The process varies, but always involves opening up an LLC, a business bank account, and an institutional account on a crypto exchange.

Pros: You can access 100+ cryptos. Fees are minimal and fixed. You take custody of all assets. Using a checkbook IRA can save you tens of thousands of dollars in fees and tax liabilities.

Cons: You’re 100% responsible for keeping custody of your crypto and staying compliant. Making sure you’re staying compliant can be a headache. Growing complexity year-by-year as the government reacts to crypto assets. If you commit a prohibited transaction, it could disqualify your IRA.

Folks I trust have told me that ReSure Financial, IRA Financial Group, and NuView are worth checking out.

Cryto IRA Accounts

Retirement accounts are special types of financial structures that allow for people to shelter their savings from taxes, or reduce taxable income today.

For simplicity, I’m just going to cover US retirement accounts. There are several basic types of retirement accounts in the US: 401k, IRA, and Roth IRA (several others exist but I’m skipping those for brevity).

Individual Retirement Accounts (IRAs) were created in 1974 and designed to encourage US citizens to save for their future. When the government decided to treat Bitcoin as property for tax purposes in 2014, they also opened the door for it to be held in IRAs alongside other alternative assets. These are the two common types of IRAs:

- Traditional IRA: A retirement account where you contribute pre-tax income, and then you pay taxes whenever you withdraw (ex: 60 years old)

- Roth IRA: A retirement account where you contribute post-tax income, and all gains then are tax-free. For HODLers this is the ultimate dream of never having to pay taxes. There are certain contribution limits, and limits based on income though which I’ll go into later.

Recommended Crypto IRA Service Provider

I went searching for a way to buy Bitcoin in my retirement account. Not GBTC or another derivative, pure Bitcoin.

I looked at a variety of options, including Bitcoin IRA, iTrustCapital, AltoIRA, and Unchained Capital. But ultimately landed on Choice for a variety of reasons:

- Cost: more transparent than other services, simpler pricing

- Custody options: subsidized, cold storage, and self custody (I’ll cover these later)

- Process: super quick and easy to get set up

- Team/Company: first qualified custodian of Bitcoin in the US

Custody Options and Cost

Choice offers 3 different ways to custody your Bitcoin:

- In-motion: Cheapest option but your Bitcoin is loaned out (fees are subsidized)

- Cold Storage: Stored with Fidelity. Fees are 1% annualized

- Self custody: Higher setup fee + $120 annual fee, but no % based fee

Process

After choosing which account type I wanted (Self-Custody), I then went to go sign up.

It took me around 4 minutes to get an account set up via their mobile app. I selected a traditional IRA, but ideally, I would have set up a Roth IRA which means that I don’t pay taxes on any gains. Unfortunately, this option isn’t available for me given my income level (single tax filers must have a modified adjusted gross income (MAGI) of $140,000 or less). Here are some other details on the two options:

Transferring the assets takes a bit longer than that though. Around 2 weeks if you liquidate your existing retirement account assets and transfer via check. Around 4 weeks if you want to transfer assets (ex: equities or bonds). This latency isn’t unique to Choice, but is primarily due to traditional brokerages that drag their feet (they want to make it hard to leave since they are losing business). Note that you can’t contribute Bitcoin to your IRA unless you already have it in an IRA. Contributions can only be made with Dollars.

Note that you can also invest in equities, metals, real estate, and other investments with Choice. It’s not just Bitcoin if you don’t want it to be.

Excellent Team

The parent company is Kingdom Trust, the first qualified custodian to custody Bitcoin in 2017. They currently serve over 125,000 clients and have over $18 billion in assets under custody.

I’ve chatted extensively with the team and they are top-notch. Loved the service, they answered every question I had. They’re also transparent with the fees, how long things will take, and what they can and can’t do.

Oh, and it’s run by a bunch of Bitcoiners! Don’t believe me? Just check out the CEO or company Twitter profiles.

Taking Action Is The First Step

The best time to stack sats was yesterday, the next best time is today.

I regret not doing this sooner. The sooner you begin the better since gains are sheltered from taxes (Even tax CPAs pushing to do this for years).

The readers of this blog post can get a $50 bonus in Bitcoin for starting crypto IRA with Choice. If it is right for you, Go For It!

Recommended article: Are You Ready For DeFi Crypto Winter?

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.

Sponsered

Crypto Taxes Made Easy

Use CryptoTraderTax to automatically generate all of crypto tax reports for the year. Click Here for a discount on yours! Coupon Code: CRYPTOTAX10

Start Earning Passive Crypto with Helium Hotspot Mining. Check It!

Earn FREE HNT Tokens Daily with Helium Hotspot. Start Your CRYPTO Passive Income Now!