Best Cryptocurrency To Invest In 2022

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

Welcome to 2022! Wish you a happy new year. Let’s start the new year uncovering crypto gems. What’s the best cryptocurrency to invest in 2022?

That is question crypto adapters ask as we close the crypto vibrant 2021 and welcome 2022. To summarize, during 2021 the cryptocurrency investors were reminded that they must be equipped to deal with volatility. This year, some countries declared Bitcoin legal tender while others banned digital currency completely. The up-and-downs are hard to miss.

Crypto 2021 Summary

With $5.7 billion of bitcoin options expired today with maximum pain price of $48k behind us, 2021 crypto was a roller coaster ride. Below are some of this year’s crypto news highlights:

Best Cryptocurrency To Invest In 2022

I found CEHV’s Blockchain OSI Model Thesis is helpful to logically build up the crypto portfolio. Each of the 11 layers roughly (although with outliers) ranges from both the lowest to highest levels of abstraction for end-users (running nodes, vs using MetaMask) and the highest potential value extraction (low margin hardware, to high margin fee abstraction on interaction protocols). Each layer is also improved and expanded in scope by the robustness of layers below it.

But, before we jump into the deep dive crypto portfolio for 2022, let’s address the elephant in the room bitcoin.Bitcoin has transitioned itself from a speculative asset class to a store of value. The entire cryptocurrency market is benchmarked against the performance of bitcoin. Several large institutions, and now even countries, hold a sizable chunk of Bitcoin in their portfolio.

- Bitcoin is the de facto hedge against “money printer go brr.” The printer has slowed down over the last six months, but make no mistake, it is very much still online. At some point there will be another crisis. We will print more money and bitcoin will respond accordingly.

- Bitcoin is the favorite asset for institutional buyers. Companies like NYDIG have quietly been building out partnerships that will allow US banks to buy and hold bitcoin for their customers.

- It is the most democratic crypto asset, bar none.

The one-year price prediction for bitcoin is a tad bit tricky, considering the massive volatility associated with it. However, before the end of 2022, we might see Bitcoin crossing the $100,000. We could see this somewhere early next year, and following that, the market might go through a correction phase.

With bitcoin out of the wau, the following table summarizes the 2022 crypto shopping list. Let’s breakdown the thesis behind these picks, why these assets, and the plausible bullcase for each individual asset.

| RATINGS | TOKENS |

|---|---|

| AAA (Strong Bets) | ETH, YFI, CVX, KP3R |

| AA (Strong Outperform / Key Catalysts) | FLX (Reflexer), CRV, ALCX, BAL, ZRX, FXS, RBN |

| A (Outperform + Top-Tier Pre-Farms) | FTM, AVAX, ZEC, Gearbox, Euler Finance |

| BBB (Value Driven / Outperform Multi-year) | MKR, HNT, LDO, COMP, RARE, SNX, SYN, GNO |

| BB (Risk-On/Unclear WInners) | PERP, FST, CAP, MCB, DPX, HND, API3, ANGLE |

| B (High Risk) | GEL, NFTX, RAMP, THALES, PICKLE, BABL, PREMIA, PENDLE |

| CCC (Possible Farming) | Cowswap, Element Finance, Opyn, Cozy Finance, Pods, Volumex |

It’s not recommended to jump start builiding a big-bang portfolio and rather smart way is DYOR finding the right price (dip) of each token and incrementally build portfolio (This is strictky not a financial advice). I am planning offer a FREE newsletter with monthly on-chan and fundamnetal analysis delivering crypto alpha to your inbox. You can subscribe to Crypto Exponentials Newsletter here. I’ll communicate the start date upon subscription.

The Thesis

The above portfilio is maily arrived at keeping in mind the possibilities of outperforming an index, major holdings (BTC) and their peers. That means there are some good projects that don’t make this list. An example is Solana had a breakout year, it would be tough for it to outperform the market again next year. Most of the picks are having the following common characterstics

- A working product

- Have a catalyst that makes 2022 a potential year for it

- Has room for growth against its peers

- Bonus for anything with external cashflow.

As a long term value investor, it’s a good practoce to rebalance portfolio (I’m personally willing to have 50%-60% miss rate, hold projects for 5+ years, and eat losses for up to 3 years on any buy for longterm yields). Investing in real assets that aren’t just hype is like startup investing, you need to be in it long term.

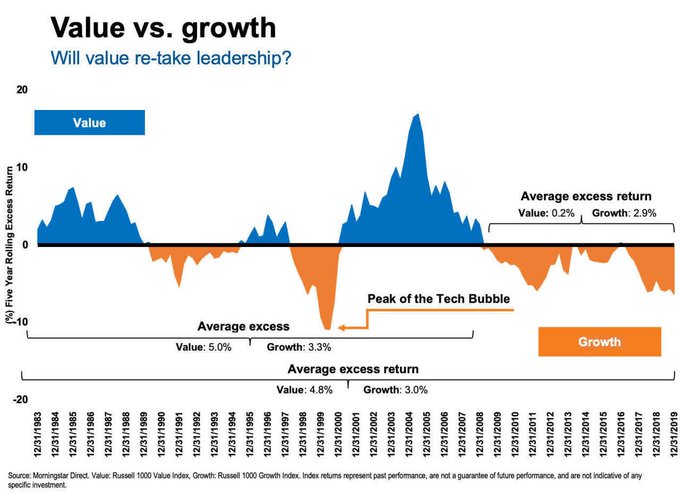

When traditional markets go through this we see a rotation from what we call “growth stocks” to “value stocks” as people seek real stable returns to shelter speculative monetary gains. In most crypto cycles we didn’t really have the equivalent of “value” stocks. Almost everything was priced on its ‘future’ (and lets be honest, retail has no clue what things are worth, especially in the future)

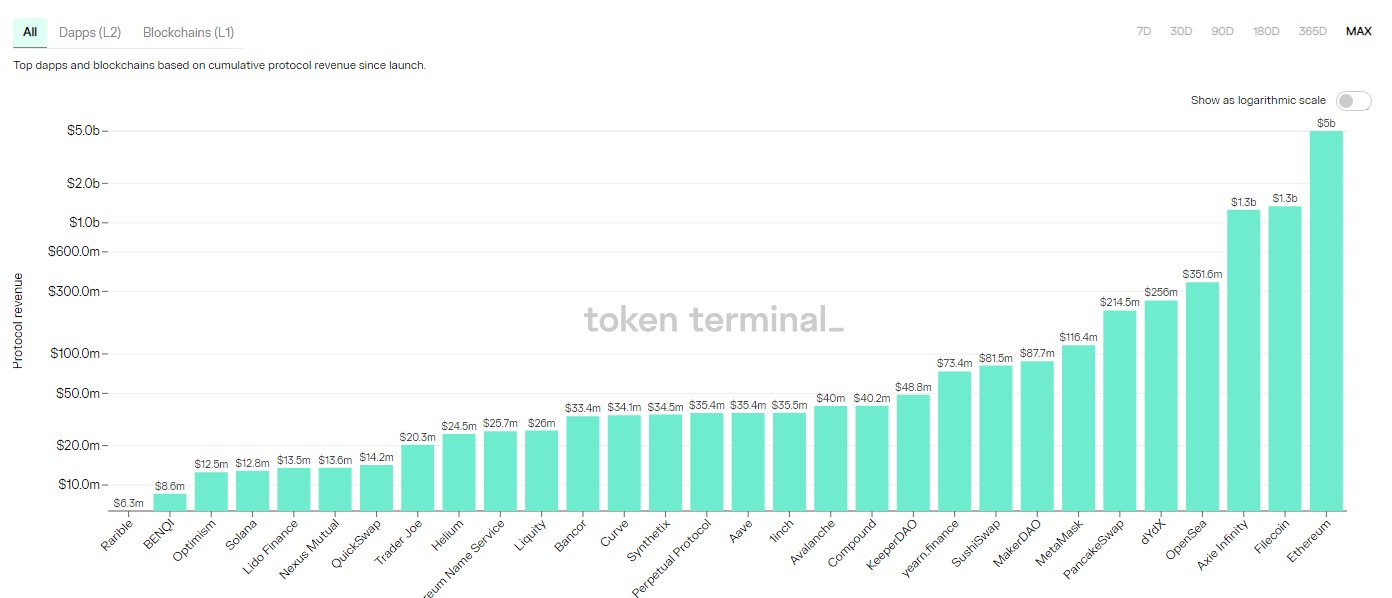

But, as crypto adoption has grown, that’s start to shift, we start to see protocols that do make revenue. TokenTerminal gives us a great overview that a number of protocols are starting to drive real revenue.

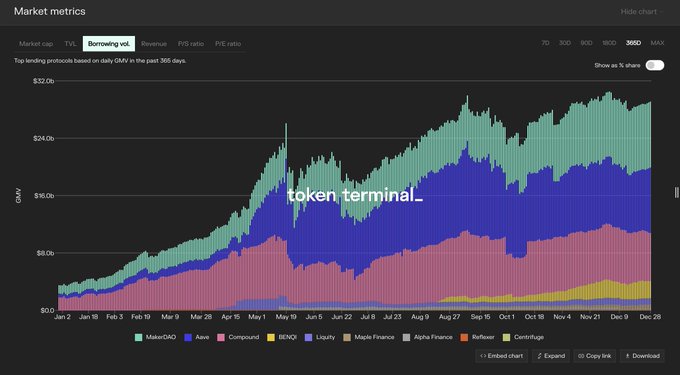

Even protocols that don’t drive give revenue to a token (yet) still see huge demand, such as lending protocols which had an average 10x increase in borrow rates in 2021.

Dissecting the quality and origin of the revenue is important (and complicated) but what is clear, is that protocols that have *actual* revenue have often drastically *underperformed* in 2021. Because 2021 was a crypto growth cycle, where while trapped at home, with stimulus checks in hand, and eyes all a glow we collectively looked at markets and thought “Yup this dog coin is probably the future”.

so anything that didn’t bottle up hopium was punished and drastically over sold. Because the reality is, most people have no sense of the time, complexity, cost, or upper bound potential of a growing business. At the end of the day all that matters is cash and value. If you provide a valuable service worth protecting or controlling, people will buy. If you have a profitable product that shares revenue, people will buy.

Because cash sustains teams of builders, builds products that can cross the chasm, and that can provide value. That’s why you’ll see a lot of my 2022 picks have classic defi products of teams who have spent 5+ years building in any market.

The second category is infrastructure. We learned this year with the L1 boon, that there are a lot of gaps in our tooling. In the CEHV Blockchain OSI investment thesis referenced above talks a lot about the gaps we need to fill for the mainstream.

We haven’t made a lot of strives in that this year. Not nearly enough. But what we did do is validate the demand. We saw L1s and L2s pop-up that taught us how painful, slow and insecure bridging can be. We also learned that in L2s with offboarding times, people are willing to pay a strong premium for instant offramps.

And with Vitalik’s “Endgame” post earlier, we learned that the path forward for Ethereum actually looks *A LOT* like a multichain world. When shards exist, moving between them is kind of like moving between L2s. We’re starting to see that in some of the planning that Avalanche is doing around subnets, and that projects like Cosmos and Atom have been thinking about as well.

All of this validates a huge key problem. In a multichain world, data and asset availability is a massive gap. We need reliable data, across networks/chains/ shards, and to move assets quickly in that manner. Most of the solutions for this like multichain dexes, onchain identity, or full blown scaling solutions won’t have their outperform case in 2022. (I’d guess 2023-2024) But a few like real world assets, onchain futures, and bridges are probably ready for primetime.

Infrastructure plays are a dime a dozen, and most of them will underperform. It will be like the AMM boom we saw post-Sushi, where 99% of them will fail. But the winners will make out like bandits capturing multi-year marketshare.

Other things may pop up during the year, maybe we stumble into a new defi primative, or a new scaling tech that gives a real boon. But all of those feel ephemeral to me. I have no interest in investing in bandaids. Instead 2022 is the year focused on real value drivers that I think can breakout, out perform in 2022 and then hold and sustain value moving forward.

Let us dive into the picks and details.

AAA (Strong Bets)

Strong Bets will outperform and continue strong. They are basically things that I buy, stake/lock, forget about for a decade and feel good about it. A big driver of this category is not that I think they’ll only strong price appreciation moving forward but that they have lucrative external return drivers. That means returns from staking/locking these assets have APY payouts that cover a lot of the cost risk of the asset, and are external non-dilutive revenue. More importantly, most of these assets are also major enough tokens that you can borrow liquidity against from multiple providers allowing you to defer taxable events while still making other plays.

ETH: This one should be obvious. ETH 2.0 drives huge economic cycles. As the merge gets closer, the drums of a flippening will beat louder. The prediction for ETH 2.0 to really create a huge upcycle in price was also before EIP-1559 was implemented and so this just becomes tenfold. With scaling solutions growing, ETH burning in EIP-1559 and a merge on the horizon, ETH is that multi-year hold that will be tough to beat, and I think it will out perform any other major.

YFI: For Yearn, their growth, external revenue ($100M~/year) (with no incentives), changing token model, upcoming buybacks ($45M) and use case make this token break their ATH this year.

CVX: Crypto veterans call it a “kingmaker” of DeFi.It would likely continue to be strong into 2022. Top reasond includes,

- Votium Bribes: They grew way faster than I expected and validated the model.

- Curve V2: Will scoop up most AMM volume for new projects (and therefore Bribes)

- Convex is expanding outside of just Curve (see cvxFXS)

It’s promising just continue to lock and farm CVX (which is like a 50% APY, and roughly 2.4 P/E equivalent from vote bribes) and for CVX to maybe post another 2x over the year. With those changes that rapidly evolved in the tail end of this year, it’s still probably wouldn’t flinch if $CVX was an 8x-10x from current value over the next few years. That would still put it in one of the most profitable P/Es around.

KP3R: General thesis is: You are getting two protocols for the price of one. -FixedForex is basically Andre building Curve for international currencies. TradFi Forex does $6.6 *TRILLION* per *DAY* offchain. Eventually some comes on chain. Keeper is rapidly growing that market, and it helps change the game for international users, because payment rails chew us up. Another guess is that at somepoint $CVX starts gobbling up #KP3R the same way they are about to do with FXS. That’s going to add compounding value to both of them.

AA (Strong Outperform):

This category is assets that I think have a key catalyst in 2022 to strongly outperform their peer groups. Many of these assets land here by being way over sold but driving revenue, a few are growth potential.

FLX: Creators of the $RAI stablecoin, The purest of stablecoin money, strongly overlooked, plenty of key catalysts. In the long term web3 probably adopt its own floating money and you’ll see a weakening of the dollar denomination. $RAI is the perfect candidate. That’s its long term driver. 2022 though is its first pass breakout.

CRV: As the value of emissions for its stablepools gets over frothed, Curve 2.0 changes all of that. Curve 2.0 is crypto<>crypto pools rather than stable<>stable pools. Right now, new projects often incentivize their staking via Sushiswap Onsen pools and majors often trade on Uniswap. UniV3’s complexity leads to a lot of traders losing capital in an unsustainable manner. It’s great for pro market makers, but, mainstream users aren’t a fan of the complexity.

Sushi is also going through its own turmoil (being addreed by powerful Devs now), it will take a while to get their footing right. This leaves a big gap in the AMM marketplace. Most of this gets absorbed by $CRV, $BAL, and $ZRX (more on those other two later) But Curve incentives will *EASILY* become the new way that projects incentivize their pools at launch. That will bring Curve new users, help them capture routing volume, and make way more projects interested in Convex and Curve. The only way this doesn’t play out is if Curve moves too slowly on rolling out more V2 pools, or governance blocks too many gauges.

ALCX: It’s one of the highest risk assets in these high tiers, but also such high potential. The self-repaying loans from @AlchemixFi are one of the most brilliant new DeFi designs we saw over the past few years but it wasn’t without its snags on things like tokenomics and efficiency rates. They’ve went back to the drawing board and been working on AlchemixV2 which solves a lot of key problems and makes some ambitious new additions.

When we think about growth rather than value, the most important question is “Can this be a foundational primative that other protocols use?” And here the answer is an overwhelming yes. The self-repaying loan model creates huge opportunities for investors to take on risk and leverage in an evolving system, but have a capped downside in return. And the addition of new strategies models make it essentially like a mini-Yearn which you borrow from and self-repay.

This is one that I’m prepared to eat multi-year loses on if I have to, because I think it changes the game. But, I think the V2 launch is likely a game changer for $ALCX and that it will out perform next year.

BAL: Balancer is one of those classic defi protocols that’s been dramatically oversold and overlooked. Balancer has a huge potential to be one of the most important AMM’s in the space, regardless of if anyone goes to their site or not. Balancer is good at making incredible foundational and flexible tech. That tech struggles to be gas efficient, which held it back, but it acts as an incredible building block, that underpins some great use cases and high performance capital efficiency.

And their partnerships with Gnosis on Cowswap will lead to them being a key component of treasury management in the future. The classic defi is going to have a strong year, I think $BAL has a huge potential to outperform, especially with their shift to a veToken model (which makes them another great Convex candidate). While they likely outperform this year, I think their real strength will be on a multi-year time horizon, where I make the contrarian bet that they will be a top AMM by underpinning treasury volume, indexing and LBP token offerings. Those are things that no one else can do with the multi-asset capital efficiency that Balancer has. So its a market that is all for them if they execute correctly.

ZRX (0X): The @0xProject is another oversold overlooked defi infrastructure component that I think makes 2022 its breakout year driven primarily by the adoption of end user wallets. It actually plays into both components of my 2022 thesis, as it is both something with strong external revenue/adoption, and a key pillar of a multichain future, as 0x is the strongest competitor for building cross chain dex tooling.

If we think of $ZRX in relation to the CEHV Blockchain OSI model, 0x is going to sit at a lower layer of infrastructure and be the tooling that most chains and wallets adopt for order filling. Currently, users use 0x without knowing it when swapping in MetaMask and other major wallets, and as we see retail expansion through accessibility in L2s that trend is going to continue.

The likely launch of a MetaMask token, and some key tooling upgrades for RFQs and crosschain trades with the expansion of L1s and L2s in 2022 will make it a driver year for 0x but there is a also a long term consideration here. The tokenomics are underwhelming to some, which keeps the price oversold for sure, but I think there is a future where 0x is as ubiquitous as leading banking software which will strongly drive rewards for node operators and in turn staking.

FXS: Frax is probably the best integrator in the stablecoin space. It has proven time and time again to be strong executors at trying new financial models, but absolutely the best at building diverse, value-added bridges with other protocols. The most recent example is their partnership with Convex on the Frax FPI and cvxFXS integration which is set to do its airdrop in the coming weeks. And once the vote allocation starts, it just becomes a flywheel.

If there are two things that are worth not underestimating in this space, its relentless builders and relentless build bridgers. Frax is both.

RBN: Ribbon is one of the few assets I like that is in a rough spot from FDV. But, I think the tokenomics, distribution model, upcoming lockup model and external revenue more than make up for it. No matter how hard we try, we’re not going to be able to teach 99% of people to properly use options.

But that doesn’t mean that options aren’t insanely lucrative, if used correctly. Ribbon, in my best TL;DR, is kind of like Yearn for options. Users stake in a vault, that uses a defined pre-built options strategy, and benefit from it. As we’ve seen with Yearn, the best strategies for vaults are the ones that are so complex that even if you know what the are doing, you can’t really replicate it. Probably most of the vault stakers in Ribbon, cannot replicate the execution of their vault strategy, but they are probably pretty happy to get 30% returns on things like ETH and USDC.

This means that Ribbon drives value, from external rewards and not just $RBN distribution. And, since its not farming like Yearn vaults, it’s models can make solid returns in bull, bear or crab markets. Which is pretty unique for the space. Just like a large amount of retail can’t build advanced farming strategies, and need Yearn, most people can’t build options strategies and need Ribbon. Ribbon needs more options participants to grow.

Most options protocols need volume providers to grow and can’t easily onboard users, at scale, without…well chaos. So Ribbon, and the upcoming boon of onchain options protocols actually make each other viable. Not to mention Ribbon is reworking the tokenomics and switching to a veToken model, which makes them a lockup flyhweel and yet another primate candidate for future Convex integration (are you seeing a trend yet?)

I’ll elborate the remaining categories and their tokens in the next blog post.

Subscribe to the FREE newsletter Cryproto Explonentials That Offer Curated Intelligence Based On “Fundamental + Techical + OnChain” Analysis. “Crypto Alpha Straight To Your Inbox”

Related Article: 2022 Forward: Bitcoin Price Prediction

Disclaimer: Past performance is not indicative of future results, you could lose some or all of your money. Buying/selling digital currencies is extremely volatile and may not be suitable for all people as the price can change drastically in a short amount of time. Never risk more than you are 100% comfortable losing. Anyone wishing to buy/sell digital currencies should seek his or her own independent financial or professional advice.

Sponsered

Buy & Grow Bitcoin TAX FREE With Choice IRA

Buy Bitcoin directly in your IRA with my partner Choice IRA (which is also a great way to save on taxes ![]() . $50 in free Bitcoin when you sign up!

. $50 in free Bitcoin when you sign up!

Crypto Taxes Made Easy (Get Started For FREE)

We’re launching a brand new crypto tax app…

10% OFF is applied when you file taxes. Whether you’re trading cryptocurrencies, buying and selling NFTs, or staking on DeFi protocols, CoinLedger makes tracking your portfolio and reporting your taxes easier than ever. Join the wailist.

Successful Path to DeFi With Crypto Swap Profits

Crypto Swap Profits is a training and ongoing online mastermind with a focus on Decentralized Finance Crypto Trading. This is an emerging area of trading and 99.9% of the world has no idea this even exists. This is the cutting edge of Crypto Trading and there is a window right now before the rest of the world starts doing this

Join Joel Peterson for a free webinar session where he’ll be going to share with you the Window of Opportunity in the DeFi crypto space. He will be sharing a TON of content and show you exactly what we are doing. At the end of the webinar, you will be able to go copy what he’s doing. We like to call it “SWAP PROFITS“.

Start Earning Passive Crypto with Helium Hotspot Mining. Check It!

Earn FREE HNT Tokens Daily with Helium Hotspot. Start Your CRYPTO Passive Income Now!