All About Stablecoins: A Key Lego In The Crypto Ecosystem

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

Stablecoins that are pegged to a specific value, are one of the most powerful tools in the crypto marketplace, but they are often misunderstood by market participants. With all the different stablecoins list on the market, it can be tough to figure out which stablecoin to use. In this blog post, I tried to demystify the sector to bring clarity to the different types of stablecoins list and key risks associated with each type.

What Is a Stablecoin?

Stablecoins are a category of cryptoassets that are meant to maintain a constant value (typically $1 USD). They have become an integral part of the ecosystem – in 2021, supply was up 388% to $140bn+ and annual transaction volume surpassed $5 trillion.

Stablecoins are one of the most important aspects in all of crypto. All major trading pairs on CEXs and DEXs alike are denominated in stablecoins. Volumes of stablecoins often exceed BTC volumes and ETH volumes. Stables are by far the most borrowed assets on decentralized money markets (27x more USDC is borrowed on Aave than ETH). Yearn’s most popular yield vaults are stablecoin vaults. Perpetual exchange protocols, which offer the most popular derivatives, are almost always collateralized against stablecoins.

They become increasingly important in a bear market as investors look for safer hiding places to shield their crypto holdings from volatility in other tokens. But all stablecoins are not made the same, and investors should be prudent in which ones they decide to park their funds in. Let’s dive into the landscape.

Stablecoins List / Landscape

Stablecoins are the foundation of nearly all that is DeFi. However, not all stablecoins are alike. Tradeoffs exist for all stablecoin implementations. Each stablecoin exists along a spectrum of decentralization, stability, and efficiency. Together, these aspects formulate the stablecoin trilemma which plagues stablecoin designs as optimization along one aspect usually leads to degradation in another. The stablecoin trilemma can be defined as:

- Decentralization: How dependent is the stablecoin on centralized systems?

- Stability: Does the stablecoin remain at its peg without large variances, especially during times of market volatility when stable assets become high in demand?

- Efficiency: How much capital is required to secure the stablecoin? More capital required, the less efficient and vice versa.

Snapshot of Top Stablecoins by Market Cap (2/4/2022); Source: https://www.coingecko.com/

Stablecoin implementations largely fall into three categories: Fiat, Collateral Debt Position (CDP), or Algorithmic (algo).

1) Fiat Stablecoins

Fiat or Centralized stablecoins (e.g., USDC, USDT, BUSD). Backed by fiat reserves and issued by known legal entities subject to regulatory laws of their jurisdiction. USDC for example is issued by Circle in the US, USDT by Tether in Hong Kong, etc. For each 1 unit of stablecoin issued, these entities hold $1 USD of collateral in their reserves which serves as the coin’s backing. These reserves are externally audited on a regular basis.

These assets are considered to be “off-chain” assets because thecurrency reserves that underpin the token value are not held on blockchain networks. These asset reserves are typically controlled by a centralized authority and held by a financial institution like a bank. In some cases, the stablecoins are backed by short-term commercial paper, as there has been some controversy with a few issuers who have not formally proven their reserves or have chosen to back the tokens with a mix of these various real-world assets (i.e.commercial debt) instead of only using US Dollars as collateral.

2) Collateralized Stablecoins

CDP postions are decentralized stablecoins which are not controlled by a centralized entity, and instead are governed by decentralized autonomous organizations (DAOs) entirely on the blockchain. As centralized stablecoins have received regulatory scrutiny, there have been increased focus and investments into decentralized stablecoins which are further reach for regulators.

Colllateralized stablecoins can be crypto backed or commodity backed.

2a) Crypto Backed:

These stablecoins are over-collateralized (e.g. DAI by Maker, MIM by Abracadabra). These stablecoins are issued in exchange for collateral deposited by users. For example, a user deposits 1 ETH (currently ~$2500) into an Abra vault and in exchange the protocol will issue her up to 90% or ~$2250 MIM.

2b) Commodity Backed:

Commodity-backed stablecoins are another unique solution to the stablecoin dilemma, but these tokens take a different approach than those that are pegged to a fiat currency like the US Dollar. As the name would suggest, these types of stablecoins are actually pegged to the valueof a commodity like oil, real estate, or precious metals, the latter of which is the most common within the category.

These tokens are collateralized by a physical asset, so thetokens actually bring the real-world value of an asset to the various blockchain networks. Paxos Gold (PAXG) is a great example of this type of stablecoin, with each PAXG pegged to thevalue of 1 troy ounce of gold that is collateralized by 400oz gold bars stored in physical vaultsand managed by Paxos, the company that built the network.

Commodity-backed tokens are only as stable as the value of the underlyingcommodity, so this type of stablecoin can see a lot more price volatility than those that are tiedto the value of a fiat currency, but the primary selling point for this type of stablecoin is areduced risk of inflation or collapse, since they are collateralized by assets that are typicallyused as hedges against fiat markets and inflation.

3) Algorithmic (Non-collateralized) Stablecoins

(e.g., UST, FRAX, FEI) maintain their peg via various algorithmic incentives and are often partially collateralized. The most popular of which is UST issued by Terraform Labs. UST is partially collateralized by the Terra ecosystem’s native Luna token. When UST trades below $1, users can exchange 1 UST for $1 of LUNA; when UST trades above $1, LUNA holders can exchange $1 of LUNA for 1 UST. Others include FRAX, which uses a fractional reserve system and FEI by Tribe DAO which relies on ‘protocol controlled value’ (PCV) to maintain peg.

Stablecoin Market Perspective

Since fiat-backed stablecoins require a trusted centralized partner and collateral debt position tokens require overcollateralization due to the volatile assets accepted as collateral, algo stablecoins present the best opportunity for DeFi to solve the stablecoin trilemma with a scalable, decentralized, and efficiently scalable stablecoin. And decentralized markets are echoing this sentiment. Demand for stablecoins which can solve the trilemma and ensure long-term viability have skyrocketed over the previous year.

In Q4, the Algo stablecoin market cap grew 260%, significantly outpacing fiat and CDP-based stablecoins which expanded market caps by 18% and 87% respectively. At this pace, algo stablecoins are set to pass collateralized debt stables as the second largest category of stablecoins in Q1 2022. However, there is a significant differential between the supply of fiat stablecoins and algo stablecoins. Fiat stablecoin market capitalization is roughly 10x more than both collateral debt and algo stablecoins. This value gap is the market opportunity for algo stables as the more efficient scalability properties play out over the next year.

Stablecoin Liquidity

In addition to each stablecoin’s various peg mechanisms discussed above (e.g., overcollateralized, algorithmic, etc.), it’s important to keep liquidity under consideration. A stablecoin’s depth of liquidity on DEX’s is crucial in ensuring the peg is not lost. Even if the stablecoin’s underlying collateral / reserve assets are sound, if there isn’t sufficient liquidity, large trade volumes in one direction could cause a de-peg, at least on a temporary basis. As such, stablecoin issuers will often incentivize users to provide liquidity in various DEX’s.

Curve, Uniswap and SushiSwap are some of the more common DEX’s to trade stablecoins– with Curve having by far the largest transaction volume.

Use Case: Deep Dive Into Recent MIM and UST Stablecoin Depegging and Liquidations of Leveraged Positions

To throw the light on recent challenges in stablecoin space, trying to bring a viewpoint on recent MIM-UST depegging.

MIM

On Thursday 1/27, revelations came out regarding Wonderland’s pseudonymous CFO 0xSifu being Michael Patryn - the co-founder and convicted fraudster of Canadian crypto exchange QuadrigaCX which defrauded investors of ~$170M in 2019.

It was also revealed that Wonderland’s lead Daniele Sestagalli had been aware of 0xSifu’s identity yet failed to take any action. Investors thus fled Wonderland, driving its token $TIME down ~40%.

Given Daniele also leads Abracadabra, investor fear spread to the correlating Spell and MIM tokens. Investors began to remove collateral from Abracadabra, and dumping their holdings of the MIM stablecoin. Abracadabra TVL suffered a sharp drop from ~$6Bn to ~$3Bn. MIM also came under heavy sell pressure – resulting in a de-peg to a low of $0.951. The flagship MIM-3CRV pool on mainnet Curve went from a stable 50% MIM balance on early Thursday to a high of 95% MIM later in the day, only permitting swaps of relatively low value.

The peg has slowly recovered since then to $0.99+ but the MIM-3CRV pool still remains imbalanced at 91% MIM and 9% DAI/USDC/USDT:

As of 1/29, Dani and the Abra team have not disclosed any plans on how to get the ratio back to normalized levels. We would assume additional SPELL bribes to the MIM Curve pool gauge will need to play a role. However, if a healthier ratio closer to 50/50 or 60/40 is not held, that would be wary of holding any MIM.

UST

One of the largest cauldrons within Abracadabra had been the UST degenbox. This strategy leveraged UST deposits into Abracadabra via MIM borrowings and deposited the leveraged UST funds into Anchor protocol on the Terra ecosystem. It accounted for a massive $1Bn+ of UST deposits out of ~$6Bn total in Anchor Earn. Worse yet, $300M of the $1Bn was held by the Wonderland treasury at an extremely high liquidation price of $0.97.

As users withdrew funds from Abracadabra, that included large withdrawals from the UST degenbox strategy which put selling pressure on UST and fears of cascading liquidations should Wonderland’s position get liquidated.

The UST/3CRV pool on Curve reached a peak imbalance of 75% UST / 25% 3CRV later in the day, but has quickly recovered back to normalized levels thereafter. UST de-pegged to ~$0.95 at its lowest point on Curve. Fortunately, Abracadabra’s ChainLink oracle utilizes multiple different data sources and did not cause the cascading liquidations in degenbox that many had feared. It has also quickly fully reclaimed its peg.

While liquidations in the Abra degenbox were avoided, we don’t believe UST is fully out of the woods. There remain two main concerns with UST

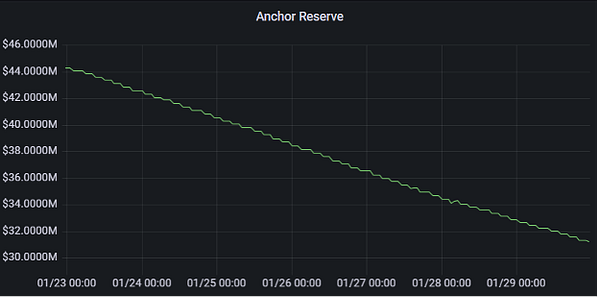

- Anchor is the largest application on the Terra ecosystem, having attracted ~$6Bn of TVL due to its stable ~20% APY offered to depositors. This APY is meant to be paid via interest earned from borrowers. However, due to recent market conditions appetite for borrowings have declined significantly and the protocol is currently only generating ~8–9% APY for borrowers. The shortfall is made up for via Anchor’s yield reserve. However, the yield reserve has been declining steadily with less than a month remaining before the 20% APY must be reduced, or the yield topped up by Terraform Labs. Should a yield top-up fail to take place, we could see large withdrawals from the Anchor protocol, again putting significant sell pressure on UST.

– Second, recall that TFL maintains UST peg via a mint and burn mechanism of the LUNA coin. Whenever UST trades below $1, investors can exchange that UST for $1 worth of newly minted LUNA and sell to USDC. This sell pressure on LUNA beyond a certain point has a risk of causing cascading liquidations and further withdrawals from UST. Essentially creating a death spiral risking significant de-pegging of the UST, much like we saw with Iron Finance in 2021.

Due to the above two factors, until there is a relative stabilization of the LUNA token price and further clarity on the Anchor yield reserve, it’s recommend to be watchful while holding UST.

Alternatives To MIM, UST De-pegging Issues

Two of the prevailing options are FRAX and FEI.

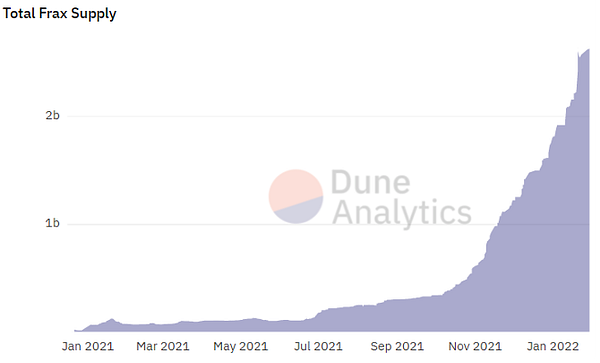

FRAX

FRAX has maintained a tight peg since launching in Dec 2020, and has shown remarkable resiliency through both the May 2021 crash and the volatility over the past few days. The circulating supply has increased to nearly $3Bn and it now ranks as #7 largest stablecoin overall and the 4th largest among the decentralized stablecoins. With part of its supply backed by collateral and part algorithmically, it achieves a remarkably capital efficient means of achieving stability, and is being increasingly adopted within DeFi.

FRAX was also one of the first to take advantage of the Convex/Curve ecosystem to gain voting power and acquire significant liquidity to its pool. As a result, it also has deep liquidity in Curve and a very healthy ratio of assets in its FRAX/3CRV pool. FRAX has also recently proposed acquiring another $25M in Convex tokens which, if passed, should further help entrench the stablecoin within Curve.

FEI

The Tribe Dao pioneered the concept of ‘protocol controlled value’ when it launched the FEI stablecoin in early 2021. FEI maintains a tight peg by being 1:1 redeemable for protocol assets. It is the next largest decentralized stablecoin after FRAX, with a circulating supply of ~$600M.

Tribe Dao recently completed a merger with Rari Capital, a permissionless lending/borrowing protocol, which will drive increased adoption of the FEI stablecoin. The team has already announced its first combined product, Tribe Turbo — which allows users to mint and borrow FEI at 0% interest via depositing any collateral into Rari Fuse.

FEI does not have as deep of a liquidity pool within DEX’s (FEI-3CRV pool is ~$200M for example vs ~$3Bn of FRAX-3CRV). While this is largely due to the smaller circulating supply, we’d like to see the Tribe DAO further incentivize DEX liquidity as FEI adoption increases.

Future of Stablecoins

Redemptions are the key stability mechanism utilized by current algo stables because each either has a one of or a combination of the following; volatile collateral (FEI), undercollateralized (FRAX), or requires volatility absorption mechanisms via a complementary token (UST). All because of one simple fact, none of these protocols have consistent, guaranteed backing 1:1 of collateral to stablecoins. Why don’t fiat backed stablecoins require sophisticated mechanisms of stability? Because there is faith in 1:1 backing of cash assets to each stablecoin irrespective of market volatility.

So why can’t an algorithmic stablecoin create the same guaranteed backing but without centralized cash backing?

UXD Stablecoin

UXD is a recently launched stablecoin protocol native to Solana. UXD aims to solve the stablecoin trilemma with a unique algorithmic design that is backed 1:1 for stable-like assets instead of relying on redemption methods to absorb volatility.

Each UXD token is backed by a delta-neutral position on a perpetual derivatives exchange.

While sounding complicated, the design is actually rather simple. Users deposit collateral such as SOL to the protocol and receive $1 of UXD in return for every $1 of SOL deposited. The SOL is then deposited to a perpetual exchange protocol (Mango Markets) as collateral and then an opposite short position is taken at the same value of the deposited SOL. So if the price of SOL falls -10%, the deposited SOL collateral would lose -10% of USD value, however, at the same time, the short position would gain +10% of USD value resulting in a net 0% move of UXD’s collateral in USD terms.

Having a net 0% move relative to the underlying asset is the definition of delta-neutral. Effectively, the UXD protocol simulates having stable assets as collateral but with volatile assets enabling it to back each UXD token 1:1 with decentralized assets.

When a user wishes to redeem UXD for collateral, the process flows in reverse. Users burn UXD with the protocol and in return receive the exact USD amount in SOL or the collateral token of their choice. To return the user’s SOL, the protocol closes the SOL short position on the perpetual exchange for the exact dollar amount of UXD burned and the freed up SOL collateral is withdrawn to the UXD protocol at which point it is returned to the user.

As a result, the supply of UXD can scale much faster and much more efficiently than CDP stablecoins since these require more USD value of collateral than stables issued. UXD with its 1:1 stable asset backed position should more closely resemble the stability of fiat-backed stablecoins, but with the added benefit of being decentralized and censorship resistant. This same stability property is an added advantage compared to other algorithmic stables which rely on redemptions and secondary tokens to absorb volatility. Mechanisms like such are highly complex and have in the past broken peg in times of high volatility.

Framing the UXD token against the stablecoin trilemma:

- Decentralization: UXD utilizes decentralized assets to form stable USD positions (delta-neutral) and the UXD protocol is itself designed as decentralized and its overall decentralization is dependent on the perpetual protocols it leverages.

- Stability: Collateral in UXD is traditionally volatile but synthetically stabilized via derivatives, recreating the dependability of fiat backed stablecoins without reliance on centralized providers. Also, the protocol design relies on 1:1 backing guarantee with collateral assets rather than complex redemption mechanisms involving non-collateral assets (FXS and LUNA) which have only had a short history combating volatility.

- Efficiency: UXD scales at a rate of $1 UXD for every $1 deposited in collateral which is far more efficient than collateral debt position stables which require more than $1 to mint $1 in stables. While the 1:1 mechanism favors stability, it is less efficient than floating collateral factor stablecoins like FRAX which can have less than $1 in collateral for every $1 in stables. Large enough perpetual markets is the chief constraint on UXD scalability, not collateral.

For the protocol to have long term viability, a revenue source is required to align incentives and fund growth. UXD Protocol doesn’t plan to collect fees from users but rather to absorb cash flows from an integral part of perpetual exchanges – the funding rate. Funding payments on perpetual exchanges arise due to the fact traders on the exchange are trading representations of tokens, not actual tokens. Since there are no actual tokens involved, the market price on the perpetual exchange can deviate from the true market price of the underlying token being traded. To keep prices aligned, a funding payment is introduced which scales relative to the trade imbalance. If the traders on the perp exchange are overweight on the long side (which is often the case in crypto), then the funding payment would be positive where the long traders pay a percentage fee to traders holding short positions. This mechanism incentivizes traders to take the unpopular side of the trade which has the effect of pushing the perpetual exchange price back towards the true market price.

Since funding historically has been positive in crypto markets, that means traders with short positions like UXD Protocol will receive funding payments from traders with long positions. However, this is not always the case and when funding turns negative, UXD Protocol requires a mechanism to pay funding payments without impacting UXD holders. To do so, an insurance fund is employed which was adequately funded ($57M) in the IDO sale of the UXP token.

Overall, like many stablecoin projects, UXD aims to drive real productive use cases for the stablecoin. Productive use cases are largely centered around financial usage as opposed to speculation or a rewards vehicle. For example, debts denominated in a stablecoin drive real usage as borrowers subsequently use the stable in swaps and continue to hold the stable in regard as their debts are denominated in the token. This drives the need for deep money market pools (borrowing) and for liquid AMM pools (swaps). Less productive uses involve staking and farming which drive liquidity but ultimately are unstable, short-term masquerades of adoption. UXD’s stated roadmap is focused on driving long-term health through more productive uses of the stablecoin.

Summary

Stablecoins serve a very significant role within DeFi. However, not all stablecoins are created equal. Investors must be prudent in selecting which stablecoins to hold and farm with, given de-peg risk and liquidity risk. This was especially evident during the events of the last few days which saw MIM and UST – two of the most prominent decentralized stablecoins lose peg to various degrees due to mass exits.

While centralized stablecoins such as USDC may provide safe harbor, they have their own associated risk with respect to potential crackdowns from regulators. Within the decentralized space, investors may consider FRAX and FEI as viable alternatives, at least while the dust settles with MIM and UST. ANother great alternative is UXD with stated roadmap that’s focused on driving long-term health through more productive uses of the stablecoin.

Recommended article: Are You Ready For DeFi Crypto Winter?

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.

Sponsered

Collect Your Vehicle Data and Earn DIMO Tokens

DIMO is building a user-owned IoT platform that allows drivers to collect and share their vehicle data. Drivers get insights about their vehicle, contribute data to the open ecosystem where it can be used to build new technology and applications, and earn DIMO tokens for participating.

Buy & Grow Bitcoin TAX FREE With Choice IRA

Buy Bitcoin directly in your IRA with my partner Choice IRA (which is also a great way to save on taxes ![]() . $50 in free Bitcoin when you sign up!

. $50 in free Bitcoin when you sign up!

Start Earning Passive Crypto with Helium Hotspot Mining. Check It!

Earn FREE HNT Tokens Daily with Helium Hotspot. Start Your CRYPTO Passive Income Now!