The Bitcoin Reality Check In Macro Economic View

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

This week Fed decided to keep interest rates where they are, but they signaled that there would likely be three rate increases in 2022. Asset prices started to rise, including stocks and crypto. The corelation among money printing (QE), market performance, and asset prices is always a boiling pot. Now crypto is getting pulled into the mix. How’re all these financial gimmicks impact crypto and Bitcoin? So let’s do “The Bitcoin Reality Check” to come up with a perspective on this.

Take a peek at the Bitcoin Fear & Greed Index. Captured below the snapshot at the time of this blog post. I started wondering why the traditional financial dynamics scaring the crypto opportunists (I belive crypto maximalists are not really getting impacted!). That led me to question – Are traditional finance and crypto strongly corelated? Is bitcoin good or bad? What’s the bitcoin reality check? To arrive at a logical point of view, digged into the macro economic scenario a bit.

Tradition Markets & Illusionary Growth

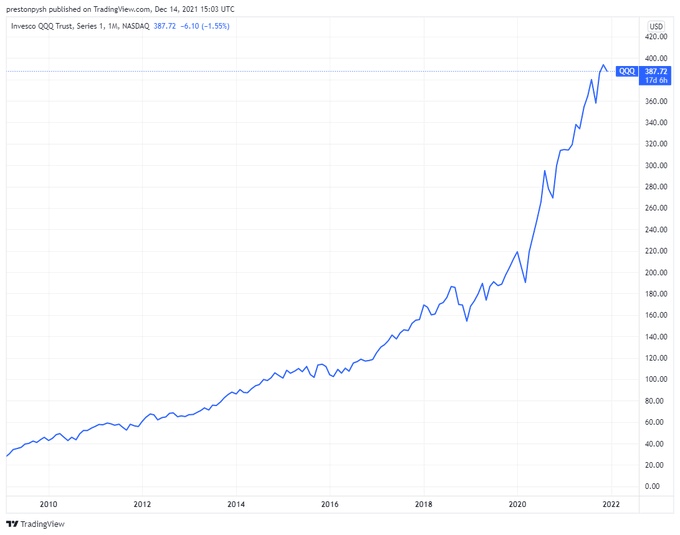

Why does everything feel like the world is falling apart, yet the stock market has looked like this since 2009? Well, here’s a thread w/ some interesting charts that will help you understand: what you see is NOT what you get.

Let’s start by looking at how the major stock indexes around the world have recovered since 2009.

Shown below, in the order they appear on the chart:

- India 638%

- USA 533%

- Japan 275%

- Korea 181%

- Europe 172%

- Canada 155%

- Hong Kong 84%

- China 75%

But…

Those were different currencies. This chart now standardized for a common currency (USD).

So, here’s the same chart, but with every index in dollar terms.

- USA 533%

- India 396%

- Korea 264%

- Japan 224%

- Canada 153%

- Europe 142%

- China 89%

- Hong Kong 83%

But…

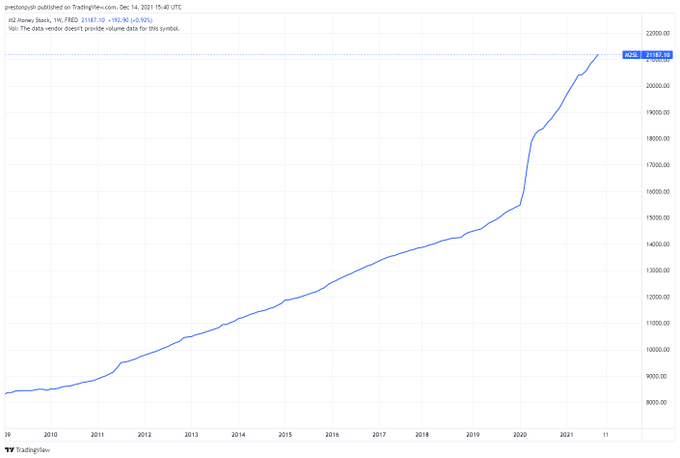

Now that we have everything in dollar terms, what if the dollar itself is also changing over time? For instance, if we look at the M2 currency supply, how has it changed since 2009. Well, below is a chart of the M2 currency supply debasing (growing in supply) since 2009.

So.. What would that make the chart look like if we adjust for M2? Well here it is: global indexes, converted into dollars, and normalized for M2.

- USA 139%

- India 92%

- Japan 19%

- Korea 19%

- Canada -6%

- Europe -10%

- Hong Kong -27%

- China -31%

So…

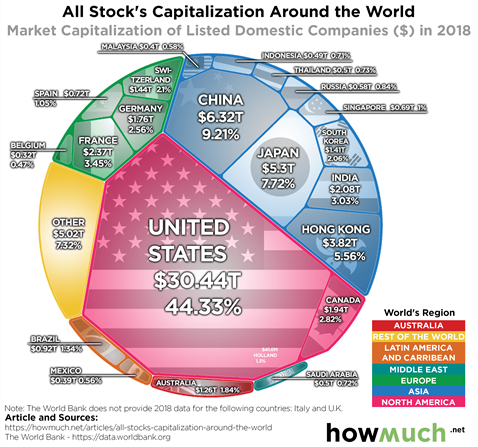

All those lines can make it hard to understand which indexes are REALLY driving the markets. Can we market weight each line so it represents it’s share of the overall economy? For instance, look at this chart from 2018 with the proportional sizes of each of these indexes…

Well, we can. Below is a consolidation of the top 80% of global indexes into a single line, market weighted for the size it represents in the global economy (all in USD terms). As you can see, the global market is up 171%.

Let’s not forget to adjust that consolidated global chart and account for dollar debasement (M2 money supply growth).

Oh, here’s THAT chart. up…6.9%…..Since the 2009 bottom – 12 years ago.

So what’s the point?

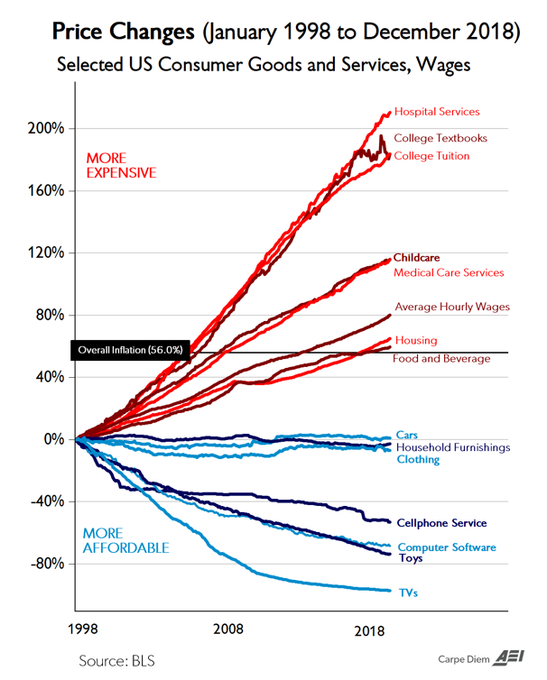

The point is this. Central banks are trying to do everything possible to keep the global economy afloat. Through their constant manipulation of the currency supply, they are obliterating the middle class & adding immeasurable systematic risk to the system.

These actions are pushing more and more equity into the hands of the few while causing the rest to go deeper into debt, while owning nothing that generates free cash flow. The prices of any labor intensive service keeps skyrocketing because of these manipulative policies (BTW old chart below)

The Bitcoin Reality Check: Is It Response To Volatility?

So what can you expect from all the above? Volatility. And lots of it. And if you think it’ll be predictable, good luck. Predicting cascading credit impairment is akin to predicting avalanches (complex systems). I own #Bitcoin because it’s the one thing they can’t manipulate or control.

It is well established at this point that bitcoin is the best form of sound money the world has ever seen. Bitcoin excels in each of the qualities of money: durability, portability, divisibility, uniformity, scarcity and acceptability.

Having bitcoin as a global reserve currency will empower more than just the United States and otehr developed nations. It will especially benefit citizens in countries with hyperinflated currencies (Venezuela, Zimbabwe, Argentina, etc.), as well as countries oppressed by dictatorships and other non-democratic forms of government. Fortunately, bitcoin gives the global citizenry another choice for storing their wealth.

In Summary..

Remember it’s not about nominal fiat gains. It’s about protection and growing buying power. If there’s one thing I’m confident of, it is this: the manipulative actions of central banks will continue to accelerate and fiat debasement will keep getting worse.

Take a big picture view to plan your way forward…

Related Article: 2022 Forward: Bitcoin Price Prediction

Disclaimer: Past performance is not indicative of future results, you could lose some or all of your money. Buying/selling digital currencies is extremely volatile and may not be suitable for all people as the price can change drastically in a short amount of time. Never risk more than you are 100% comfortable losing. Anyone wishing to buy/sell digital currencies should seek his or her own independent financial or professional advice.

Sponsered

Crypto Taxes Made Easy

Use CryptoTraderTax to automatically generate all of crypto tax reports for the year. Click Here for a discount on yours! Coupon Code: CRYPTOTAX10

Successful Path to DeFi With Crypto Swap Profits

Crypto Swap Profits is a training and ongoing online mastermind with a focus on Decentralized Finance Crypto Trading. This is an emerging area of trading and 99.9% of the world has no idea this even exists. This is the cutting edge of Crypto Trading and there is a window right now before the rest of the world starts doing this.

Join Joel Peterson for a free webinar session where he’ll be going to share with you the Window of Opportunity in the DeFi crypto space. He will be sharing a TON of content and show you exactly what we are doing. At the end of the webinar, you will be able to go copy what he’s doing. We like to call it “SWAP PROFITS“.

Start Earning Passive Crypto with Helium Hotspot Mining. Check It!

Earn FREE HNT Tokens Daily with Helium Hotspot. Start Your CRYPTO Passive Income Now!