Food For Thought on Crypto “Overleveraged”

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

“Leverage-Overleveraged-Liquidation” is how I narrate the third wave of crypto revolution. While the underlying technology is progressively being built and innovated, the greed is creating sporadic market peaks & lows and crypto markets are now overly financial reengineered. As the transparency is getting hidden between CeFi and DeFi, do we curse the “decentralization”, the core principle of blockchain technology amidst this turmoil? Let’s dive in!

Fear and greed pretty much rule every market on the planet and it’s a major reason why we tend to see boom and busts play out similarly across financial markets. There’s an eternal debate over which is more powerful – fear or greed – and I’m of the opinion that they can both be as powerful as each other though just in different contexts.

Roots of Crypto Overleveraged (Bear) Market

Over the last few months we have seen this crypto bear market humble so many people who people thought were invincible. Terra and Do Kwon (and all the funds/people involved with Terra), Celsius, Three Arrows Capital and more. This is typically what we see when the easy money stops flowing and markets come crashing down – there’s actually a saying on this from Warren Buffet himself: “only when the tide goes out do you discover who’s been swimming naked.” Translated for crypto, this means that only when everything stops ‘mooning’ do you discover who was actually a good investor and who was just lucky.

1) Leverage

Leverage plays a major part in all of these blowups and really the use of leverage stems mostly from greed. Leverage also tends to daisy-chain between lenders and can cause a really big cascading effect in a downturn because of all the distributed risk. It gets especially bad when there’s a “liquidity crunch” where people/funds that are on leverage need to pay down their debts by selling volatile assets (which are falling in price as they try to sell them). This is pretty much what we’ve been seeing over the last few weeks and a major reason why the prices of BTC and ETH have gone down more than most people expected.

This is all why using leverage, it’s just not worth it. One of the worst things that can happen to you in investing is blowing yourself up and being out of a position – especially as the market is going up. I actually had some friends blow themselves up in early 2020 by using leverage after holding on for the entire bear market – it was brutal to watch them cope with this loss and some were never the same again.

Of course, none of this is unique to crypto, it’s happened in the non-crypto markets plenty of times because the common denominator is humans and humans are always greedy (and fearful). What matters is how we bounce back from this and how long that takes – it could be months or it could be years but nothing has fundamentally changed about the technology – short term speculation just got way out of hand and now we all have to pay the price for that.

2) Overleveraged

Chaos is unfolding in the crypto industry as several overleveraged market participants face financial difficulties. It started with crypto lender Celsius suspending withdrawals, followed by one of the biggest crypto VCs, Three Arrows Capital facing potential insolvency. Today the crypto lender Babel Finance also suspended withdrawals.

Regulators are keeping a keen eye on these developments, and several US states have already opened investigations into Celsius. Binance US also face legislative trouble as a class-action lawsuit was filed against the exchange for promoting UST and LUNA, which imploded in May.

3) Inflation, Interest Rates, and More…

Bitcoin has lost nearly one-third of its value since last Friday, fueled by the negative market impact of a higher than expected US CPI, and amplified by the following insolvency problems rippling through crypto markets. MicroStrategy is now down more than $1B on its bitcoin bet, but Michael Saylor is still bullish, saying that ‘this is an ideal entry point to buy bitcoin‘. El Salvador’s finance minister also assured us that the bitcoin crash poses ‘extremely minimal‘ fiscal risk to the nation-state bitcoin adopter.

4) Regulation

Crypto regulation is evolving and not yet reached a common ground across nation states. Panama’s process of implementing a very favorable crypto regulation has been vetoed by the country’s president. Further north, NYC’s mayor Eric Adams is attempting to stop the state’s proposed 2-year ban on bitcoin mining using fossil fuels.

To help you navigate the array of cryptocurrency regulations around the world, their legislative attitudes and the activities associated with them, Comply Advantage has put together this guide. Learn how different nations approach coin and exchange regulation and if they have any upcoming legislation which could alter their approach to cryptocurrencies.

5) Mining

The rapidly expanding cryptocurrency industry needs to be held accountable to ensure it operates in a sustainable and just manner to protect communities. Many environmental groups, including Greenpeace and the Sierra Club, are urging government agencies under the Biden administration to implement new approaches in their response to crypto mining. Russia’s state-owned oil producer Gazpromneft plans to expand its bitcoin mining operations using stranded natural gas that otherwise would be flared. In the US, some public mining companies struggle financially, and better-capitalized companies like CleanSpark take advantage of that to cheaply acquire contracts for mining rigs.

6) Stablecoins

Crypto need a sound stable coin. Circle, the USDC stablecoin issuer, is planning to introduce a euro-backed stablecoin. Meanwhile, Tron’s stablecoin USDD, a copy of failed UST, has now stayed below its $1 peg for several days. At the risk of sounding like a broken record, algorithmic stablecoins are complete failure – smoke and mirrors at best and, in all likelihood, vehicles for Ponzi schemes. TerraUSD has taken hits for four days in a row, and now it looks extremely likely that Tron’s coin will collapse as well.

How to Survive a Crypto Overleveraged (Bear) Market?

First, Let’s qualify we’re in a bear market

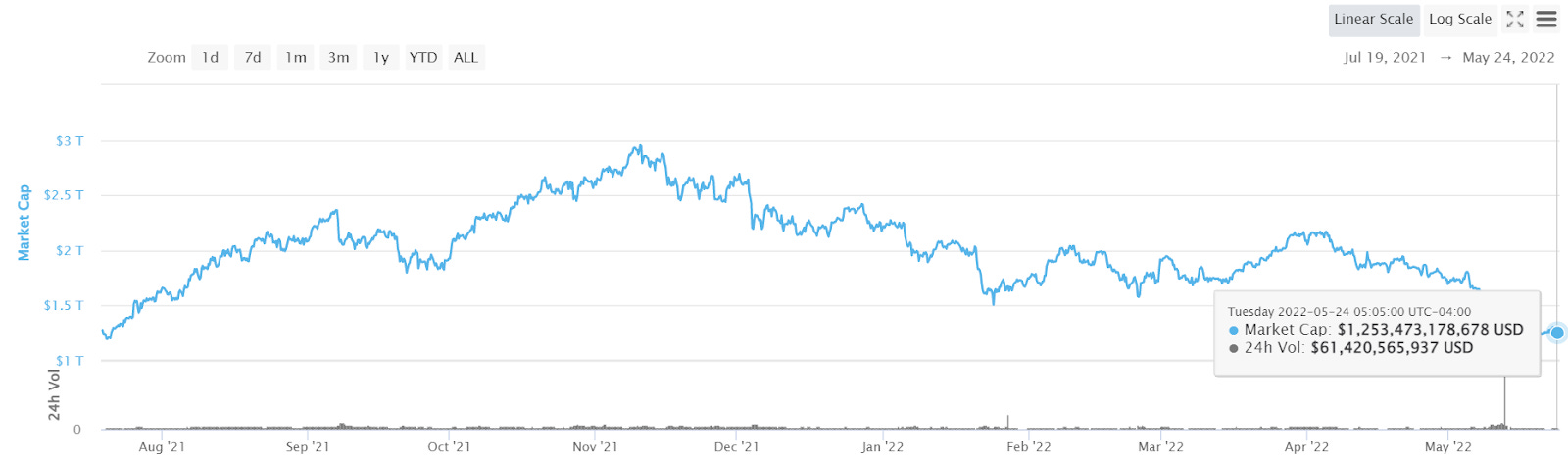

A quick look at the market shows we’re far, far down from ATHs. According to CMC, crypto’s market cap peaked back in early November at just under $3T. As of writing, crypto sits at roughly $1.25T. That’s a 58% fall over the span of 7 months. Even after accounting for crypto’s volatility, we’re still looking at three times the drawdown from the 20% heuristic.

So are we in a bear market? I’d say yes. But it’s not up to me to decide. It’s up to you and how you choose to interpret market sentiment.

Framing of Crypto Bear Mindset

For the sake of this blog post, let’s assume you’re feeling the hallmark conservative sentiment that is a bear market. What should you do?

In a bear, market conditions remain depressed as investors, institutions, and people are all less likely to take risks. Bear markets are also dangerous in a different way: they play on your emotions. It’s easy to lose faith, develop short-term tunnel vision, be anchored to previous buying points, and be driven by fear. All of these can result in impulsive decisions that can cost you.

That’s why we must first frame our intention. What is our goal? What tenets will we fall back on? What is our portfolio management strategy in the bear market?

Here are a few guiding principles:

- Bear markets are opportunities. No one wants a bear market, but if you play your cards right, you’ll benefit. I don’t want to rehash all of David’s 5 reasons to be excited for the bear market, but an important takeaway is that smart investors can steadily accumulate assets in bear markets that will net them outsized returns during the next bull run.

- Survive. This is your goal. In a bull market, your goal is to build wealth and take profits. In a bear market, your goal is to survive for the next bull market while losing as little of your portfolio as possible. If you focus on trying to grow your bag during a bear market, you’re in for an uphill battle. It’s not easy, but not impossible either. Otherwise, I suggest focusing on retaining your net worth and making it out the other end with the next bull cycle. It’s not sexy, but neither is billionaire Warren Buffet’s investment strategy.

- KISS. Keep it simple, stupid. Amidst the euphoria of a bull market, it’s easy to look like a finance genius. In a bear market, your strategies will get stress tested. So keep it simple and trust in your strategy’s long term time horizon.

Important, Evaluate your risk profile

Before we dive into any strategies, I want to first talk about risk profiles. A risk profile is a tool that investors use to identify if a particular investment falls within their appetite for risk. Here are some high-level examples:

| Risk Profile | Characteristics |

| Aggressive | Mostly small cap tokens, some BTC and ETH, no stables. Willing to use protocols that have not been audited Invests across dozens of different projects |

| Moderate | Majority BTC and ETH, some stablecoins, and some small cap tokens Stakes in higher yield pools, but is determined to understand the protocol first Uses a small percentage of portfolio to ape into projects |

| Conservative | Entirely BTC, ETH, and stables Stables are parked in a Compound market earning low single digit yields Does not keep more than 5-10% net worth in crypto |

Having a risk profile in mind will frame what types of investments you pursue in general. For a bear market, I’d recommend between a conservative to moderate risk profile as more aggressive risk profiles benefit from market manias indicative of bull markets.

In a bear market, our goal is to make it to the next bull with our portfolio intact.

Strategies to survive a bear market

1) Beginner – DCA & Hold

- First bear market

- New to investing & financial markets

- Has a full time job unrelated to crypto

The premise of the beginner strategy is simple: Choose a portfolio allocation of low-risk assets, regularly invest a budgeted amount, and forget about everything else until the market heats up.

This strategy has two steps:

- Identify which assets you want to own

- Dollar cost average into those assets and hold

Asset Allocation

The first step in this strategy is to identify which assets you want to own. These assets will be the bread and butter of your portfolio until the markets begin to heat up.

It helps to have a risk profile in mind when you make this selection. Ideally, you’ll allocate a large portion of your portfolio into blue-chip assets that you know for a fact will be up during the next bull run — like Ether and Bitcoin!

The DeFi Edge has some examples of asset allocations for different risk profiles (not a endorsement).

Dollar Cost Average

Once you’ve decided on your portfolio allocation, the next step is to budget an amount you want to periodically invest into those assets. This strategy is one of the most basic investment strategies called Dollar Cost Averaging (DCA), which we’ve written about before.

The beauty of DCA is that it removes the cognitive burden of timing the market. The premise is simple: Buy at the same time every period (like once a month). Ignore the price, just buy.

Binance @binanceDollar-cost averaging is an investment strategy that aims to reduce the impact of volatility on the purchase of assets. It involves buying equal amounts of the asset at regular intervals, like this. November 22nd 202071 Retweets429 Likes

That’s it! Just set and forget, check back in during the next bull run, and reap the rewards of steadily accumulating blue-chip capital assets.

2) Intermediate – Indices & Sector Rotation

- Has played around with multiple DeFi protocols

- Is slightly more risk-on

- Has time to watch the markets

The intent behind this strategy is to diversify your holdings as a hedge against market volatility and take advantage of little bubbles of bullishness throughout the bear.

Diversification

Any reasonable investment advice always starts with diversification as a means of spreading risk throughout your portfolio and limiting exposure to any one type of asset. The DeFi Edge tweet above is an example of diversification – but can we go one step further?

It’s one thing to diversify into a specific token. But what about an index? Indices are a basket of tokens, meaning they represent a microcosm of diversification itself. For example, Index Coop’s DPI token captures blue-chip DeFi tokens into a single basket token, spreading the risk and return of battle tested DeFi protocols across a multitude of tokens.

If you’re considering diversifying your portfolio, look at indices instead of individual tokens. Index Coop has a slew of different products, but you can find many other indices on TokenSets, or even create your own.

Once you’ve selected your preferred indices, you can DCA into them.

Sectors

You’ll notice that many indices are broken down into sectors, representing a basket of tokens for a particular market niche:

In all types of markets, some sectors will outperform others. For example, when comparing MVI, DPI, and ETH, we can see that ETH performed better in the long term. In other periods like September to December, MVI came out ahead of ETH and DPI:

This is the first bear market with such a breadth of crypto sectors. Back in 2018-2020, there was no DeFi or Metaverse to segment the market. Because of that, there’s also no data on which sectors will perform well against the average performance of the entire market.

A detailed intermediate tactic will accommodate how to invest with sector rotation, including which tokens to consider within a sector, what metrics to follow, how to set stop losses & alerts, and when to rotate are out of scope for this article. But if you have time to watch the markets, rotating in and out of stable sectors throughout the bear market is a good way to stay afloat, if not even earn a small profit.

PS. If you’re interested in a tactic on sector rotation, leave a comment below!

3) Advanced – Defensive Options Trading

- Has a background in finance or self-taught

- Familiar with options

- Bear market veteran

I generally do not recommend actively trading during bear markets. Trying to profit in a bear market is much riskier than profiting in a bull market. However, since our goal is to make it to the next bull, I will focus on defensive trading strategies. Defensive trading is a set of principles for trading in the market centered around limiting losses and volatility. Common tactics include diversification, sector rotation, DCA and hodling.

To use any of these strategies, you’ll need to find an options exchange that supports the assets you want to create a position against. Some popular DeFi-native options exchanges are:

As always, DYOR!

Protective Puts

Buying protective puts is a hedging strategy using options to limit downside risk while going long on assets.

By purchasing a put option on the underlying asset that you own, you are effectively buying an insurance policy that sets a price floor beyond which you will not lose more money, even if the underlying asset continues to fall in price.

Covered Calls

Covered calls are another options trading strategy that sacrifices potential upside to earn a current income stream.

Covered calls require you to own the underlying asset and sell a call option to purchase that asset at a set price. In a bear market, this works in your favor as asset prices may stay steady for the life of the option, allowing you to earn income through premiums earned by selling the call option.

However, the tradeoff is that your earning potential is capped if the underlying asset appreciates above the strike price.

Bear Spreads

Spread trading is a common options strategy that limits your profits and losses within a bounded range. They work by purchasing one security at one strike price and selling a related security at another.

There are two types of bear spreads: Bear Put Spread and Bear Call Spread. Both strategies work the same way: by buying options at a strike price and selling an equivalent number of options at a lower strike price. By doing so, these spreads create limited profit and limited loss trading strategies for investors that are moderately bearish.

In Summary…

If this is your first overleveraged bear market, here are some of the lessons learned between 2018 and 2020:

- Build for the long run. Stop watching the markets everyday. For the sake of your mental health, pick a strategy, follow it, and forget the numbers. It’ll pay off in the long run.

- Remember your goal. Speaking of bulls, remember the mantra: survive. If you’re experiencing FUD, remember that everyone feels FUD during a bear. Put it aside, stay conservative, and wait for the bull. It’ll come, as it does in all markets eventually.

- Invest your time. Speculators and tourists leave during bear markets, but builders stay. If you have the time to contribute to projects, you’re bound to make meaningful connections and maybe even get an edge before the next bull cycle. This is the time to educate yourself, level-up, and…

- Become a crypto user. Becoming a genuine crypto user is one of the best things you can do. Lend, borrow, stake, earn, swap–just start using crypto products. People that traded on Uniswap, registered ENS names, donated to Gitcoin, all earned sizable rewards from airdrops. You can earn some of the best yields in the world and earn ownership in key protocols while doing it. By becoming a crypto user, you’re positioning yourself for the future bull market.

- Make friends. Bear markets are the time when the crypto community huddles up to stay warm during crypto winters. This is the time to find your tribe and vibe out. These relationships will pay off in every way possible in the future–you may travel across the world with them, attend their weddings, work together. The real value of the crypto journey are the friends you make along the way 🙂

See you in the bull!

Related Reading: 3 Opportunities In Crypto Bear Market

Disclaimer: Past performance is not indicative of future results, you could lose some or all of your money. Buying/selling digital currencies is extremely volatile and may not be suitable for all people as the price can change drastically in a short amount of time. Never risk more than you are 100% comfortable losing. Anyone wishing to buy/sell digital currencies should seek his or her own independent financial or professional advice.

Sponsored

Blockchain Education Resources

Blockchain is the next Internet. Cryptocurrencies create value in the Blockchain networks. Web3, DeFi, NFTs, Metaverse, many upcoming advances in the field constantly building the infrastructure for Blockchain. Learn to join the Crypto Revolution at Blockchain Education Resources