Bitcoin Future Price Prediction

*Get your crypto project/offer published on this blog and news sites. Email:contact@cryptoexponentials.com

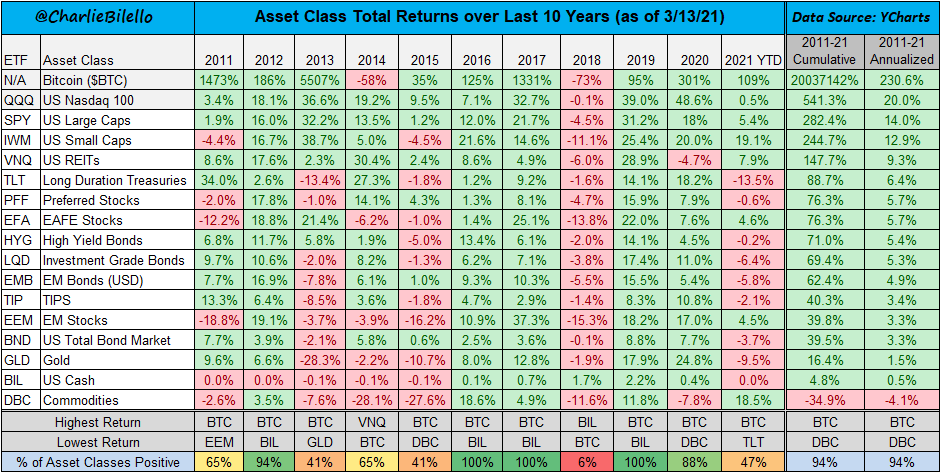

By now all in crypto marketplace understands that Bitcoin is the super volatile asset with annualized 30-day volatility reaching 116.62% on May 24, 2021. Amidst such uncertainty, since 2011, bitcoin has risen at an average of 200% and Bitcoins yearly growth in comparison with other asset classes is shown in the table below. So the most burning question on everyone’s mind is what’s the growth trajectory of bitcoin going forward and how bitcoin future price prediction works? To be honest, there is no universally accepted prediction model for crypto valuations.

Unlike in traditional finance, where institutional and retail traders have a number of data points to reference when valuing an investable asset like company’s revenue, profit, debt, etc., bitcoin lacks in such data points. That leave most of the retail crypto investors often look at the values of competing projects to see how a token value and total market capital relate to the use case of a project and how far along in development the project may be, but these metrics can be subjective and unreliable, so this approach is often more speculative than data-driven.

Given the transparency and immutability of blockchain-based assets, some of the most reliable metrics of this industry are those that quantify network size, growth, and volume, so the smart money is leveraging a field of data analytics associated with a relatively simple principle referred to as a “network effect.” This observation intrigued me to go down the rabbit hole to read a research work published by Chinese Academy of Science (CAS) titled “Tencent and Facebook Data Validate Metcalfe’s Law“

In 1980s, Robert Metcalfe, the inventor of Ethernet, proposed a formulation of network value in terms of the network size (the number of nodes of the network), which was later named as Metcalfe’s law. The law states that the value V of a network is proportional to the square of the size n of the network, i.e., V ∝ n2 . Metcalfe’s law has been influential and an embodiment of the network effect concept.

The researchers at CAS has analyzed the value of two tech giants, Tencent and Facebook, against the growth of their user base (Monthly Active Users – MAUs) and found that Metcalfe’s law provided a nearly perfect fit. As we can see in the charts below, the costs of Tencent and Facebook are proportional to the squares of their network sizes, not linear; and the growth trends of Tencent and Facebook monthly active users fit the netoid function well.

Later in 2017, researcher Ken Alabi has analyzed blockchain networks to determine if they satisfy Metcalfe’s Law, as has been shown for some online social media networks. The value of the network was modeled based on the price of the digital currency in use on the network, and the number of users by the number of unique addresses each day that engage in transactions on the network. The Bitcoin, Ethereum, and Dash networks were analyzed. The analysis shows that the networks were fairly well modeled by Metcalfe’s Law, which identifies the value of a network as proportional to the square of the number of its nodes, or end users. The full research details can be found at Digital blockchain networks appear to be following Metcalfe’s Law. The research details are depicted below.

Followed by the Ken’s research, Cane Island Alternative Investors Association (CAIA) released a paper back in 2018 titled “Metcalfe’s Law as a Model for Bitcoin’s Value” and New York Digital Investment Group (NYDIG) published another paper in November of 2020 titled “The Power of Bitcoin’s Network Effect” assessing Metcalfe’s Law as a model for Bitcoin’s value and has subsequently came to the same conclusion.

What is becoming evident from these research is that linear businesses gained a competitive advantage by buying assets, controlling supply chains, and driving transactions. Digital companies gain competitive advantages through building network effects, relationships and interactions.

Peter Fisk, a technology thought leader states that, as the network grows, it’s value multiplies. Think of a dating app. Initially a few users is very limiting, but as soon as the network grows, the opportunities to find a suitable match grow much faster. The value of the network to the user is in the number of connections possible, and for the business, the commercial value becomes the data that is generated through user to user interactions. This data can be captured and analyzed, to drive more interactions between people, and becomes the real advantage.

James Currier a General Partner at NFX, a seed-stage venture firm has published a blog post “The Network Effects Manual: 13 Different Network Effects (and counting)” highlighting 13 different types of network effects that fall broadly under direct or indirect categories [the first 5 of direct effects, the others indirect].

- Physical – infrastructure, typically utilities (eg roads, landlines, electricity)

- Protocol – a common standard for operating (eg Ethernet, Bitcoin, VHS)

- Personal Utility – built on personal identities (eg WhatsApp, Slack, WeChat)

- Personal – built on personal reputation (eg Facebook, Instagram, Twitter)

- Market Network – adds purpose and transactions (eg Houzz, AngelList)

- Marketplace – enables exchanges between buyers and sellers (eg eBay, Visa, Etsy)

- Platform – adds value to the exchange of a marketplace (eg iOS, Nintendo, Twitch)

- Asymptotic Marketplace – effect depends on scale (eg Uber, OpenTable)

- Data – data generated through use enhances utility (eg Google, Waze, IMDB)

- Tech Performance … service gets better with more users (eg BitTorrent, Skype)

- Language … a brand name defines a market or activity (eg Google, Uber, Xerox)

- Belief … network grows based on a shared belief (eg stock market, religions)

- Bandwagon … driven by social pressure of fear of missing out (eg Apple, Slack)

Direct (same-side, or symmetric) network effects happen when an increase in users directly creates more utility for all of the users, that is, a better product or service. Facebook, Tinder. Indirect (cross-side, or asymmetric) network effects happen when an increase in users indirectly create more utility for other types of users. Airbnb and Uber, where more hosts and drivers creates more utility for guests and passengers.

So now that we’re armed with this knowledge, how can we use this to our advantage? Well for one, Bitcoin and Ethereum data sets are large enough that we can map out long-term price trends to establish relatively reliable predictions of future price, and even the timeline for the valuation to some degree. These assets are clearly very bullish based on network effects. Bullishness in these two large assets is a prerequisite for bull markets to occur in other smaller crypto assets.

Additionally, the data correlation dictated by Metcalfe’s Law is tight enough that it can actually help predict over/undervaluation at a macro level. If we see the price of these digital assets rise or dip far from the model price, it should be seen as a fairly reliable signal that we may be facing a bubble or buying opportunity, depending on the direction of deviation. Spencer Wheatley of ETH Zurich and some of his colleagues came to the conclusion that “…once Bitcoin is valued in this way it becomes possible to see when it is overvalued and perhaps even to spot the telltale signs that a market crash is imminent.”

He and his team identified a few significant price crashes in Bitcoin’s history and, using a model developed by another member of ETH Zurich, Didier Sornette, were able to draw some interesting conclusions regarding macro trends in an effort to pull some credibility from the idea that a “black-swan” event can be considered a primary explanation of a market crash.

TechnologyReview.com posted an article in 2018 detailing the team’s work, stating “…in the Bitcoin crashes listed above, the triggering events are insignificant. According to Sornette, the market was already in a critical phase, and if these events hadn’t occurred, some other event would have triggered a crash instead. The situation is analogous to a forest fire. If the forest is dry enough to burn, almost any spark can trigger a blaze. And the size of the resulting fire is unrelated to the size of the spark that started it. Instead, it is the network of connections between the trees that allows the fire to spread.”

This analysis, along with the various data-intensive models cited above, gives us a strong foundation to use the network effect phenomena for cryptocurrency valuations. Additionally, the list from Peter Fisk included above can help us analyze new crypto projects according to the type of network effect they may have, especially since many new projects may be worth investing in, but the valuation of the project could be difficult to establish in the absence of significant (long-term) on-chain data.

Ultimately, network effects and Metcalfe’s Law may be one of the most valuable tools for retail and institutional traders to make data-driven decisions regarding the allocation of funds into this technological revolution that the vast majority of people are still struggling to wrap their head around. Essentially, incorporating Metcalfe’s Law into your own strategy adds yet another “smart-money” tool to your arsenal.

Related Article: Bitcoin Death Cross

Read this blog post to master Passive Income strategies: 7 Proven Ways To Make Money Fast Today

Sponsored

Cryptoverse Capital

The Only Course you Need to Start Crypto Staking Today. How We Earn Passive Income by Staking Different Kinds of Coins with Less Work and Little Effort.

Crypto Swap Profits

Crypto Swap Profits is a training and ongoing online mastermind with a focus on Decentralized Finance Crypto Trading. This is an emerging area of trading and 99.9% of the world has no idea this even exists. This is not the “Crypto” most people think about when they first hear the word.

Start Earning FREE Crypto with Lolli

Start using Lolli 🍭 to earn bitcoin when shop online. It’s awesome & you should check it out!

Zero Risk Crypto

James Renouf and along with his partner Dave Espino, we bring you a brand-new strategy in the crypto world. The Zero Risk Crypto process shows you how to get set up an innovative process and get paid today!